CLA Written Submission to Department of Finance Consultation on Strengthening Competition in the Financial Sector

ABOUT THE CANADIAN LENDERS ASSOCIATION AND THE OPEN FINANCE ROUNDTABLE

The Canadian Lenders Association (CLA) supports the growth of bank and non-bank companies that are in the business of lending, along with sectors closely related to lending such as Banking as a Service (BaaS), Core Banking, Diversity, Equity & Inclusion (DE&I), Sustainable Finance, and Open Finance. We currently champion the interests of over 300 member companies throughout Canada. These members are actively engaged in providing a broad spectrum of financing options, including for small and medium-sized businesses (SMBs), consumer financing, home loans, equipment financing, automotive loans, and mortgage services.

CLA member organizations are best-known for leveraging cutting-edge underwriting technology and innovative business strategies to meet the diverse financial needs of Canadians. Through these efforts, they not only provide essential financial services but also play a crucial role in supporting Canadians’ ability to enhance their creditworthiness and achieve financial stability.

Within the CLA, the Open Finance Roundtable serves as a specialized forum with a distinct focus on advancing next-gen services. Comprising stakeholders from the CLA’s 300+ member companies, the Roundtable collaborates to advocate for the implementation of secure APIs aimed at fostering innovation for both consumer and commercial sectors. At its core, the Roundtable’s mission is to lead an informed discussion on the long-term benefits of Financial Data Portability (FDP) within an open finance economy. Recognizing the transformative potential of open finance, the Roundtable seeks to explore the value of APIs in delivering meaningful benefits to consumers and businesses alike.

By advocating for progressive policies and fostering a community of responsible lenders, the CLA’s Open Finance Roundtable aims to ensure that Canadian consumers and businesses have access to transparent, fair, and supportive financing solutions. Our mission is to create an environment where lending practices are equitable, sustainable, and aligned with the evolving financial landscapes of today and tomorrow.

POSITION STATEMENT

In recent years, the financial landscape in Canada has witnessed notable advancements, particularly in areas such as payments modernization and open finance.

Payments Canada’s initiatives in modernizing the payments infrastructure, notably with the launch of Lynx and the highly anticipated Real-Time Rail (RTR) upgrade which was originally slated for 2022, mark significant milestones in the evolution of payment systems in Canada. Real-time payments systems have demonstrated immense potential globally, enabling instant account-based funds transfer and settlement for both businesses and consumers. The CLA’s Open Finance Roundtable views the adoption of RTR as a catalyst for innovation, fostering collaboration with fintechs and payment service providers to address pain points in payments and develop innovative use cases.

Canada’s planned implementation of a consumer-driven banking (open banking) framework is a positive step forward. As a proponent of a broader open finance ecosystem, the CLA’s Open Finance Roundtable emphasizes the urgency for government-led action to adopt an open banking and subsequent open finance framework and standards in Canada. While other countries are already considering the next evolution in open banking known as ‘Open Finance,’ the slow progress in Canada is frustrating for the fintech community. The robust technology infrastructure of Canadian lenders positions them favorably for open banking, as evidenced by successful partnerships with innovative fintech companies for various services, such as international money transfers.

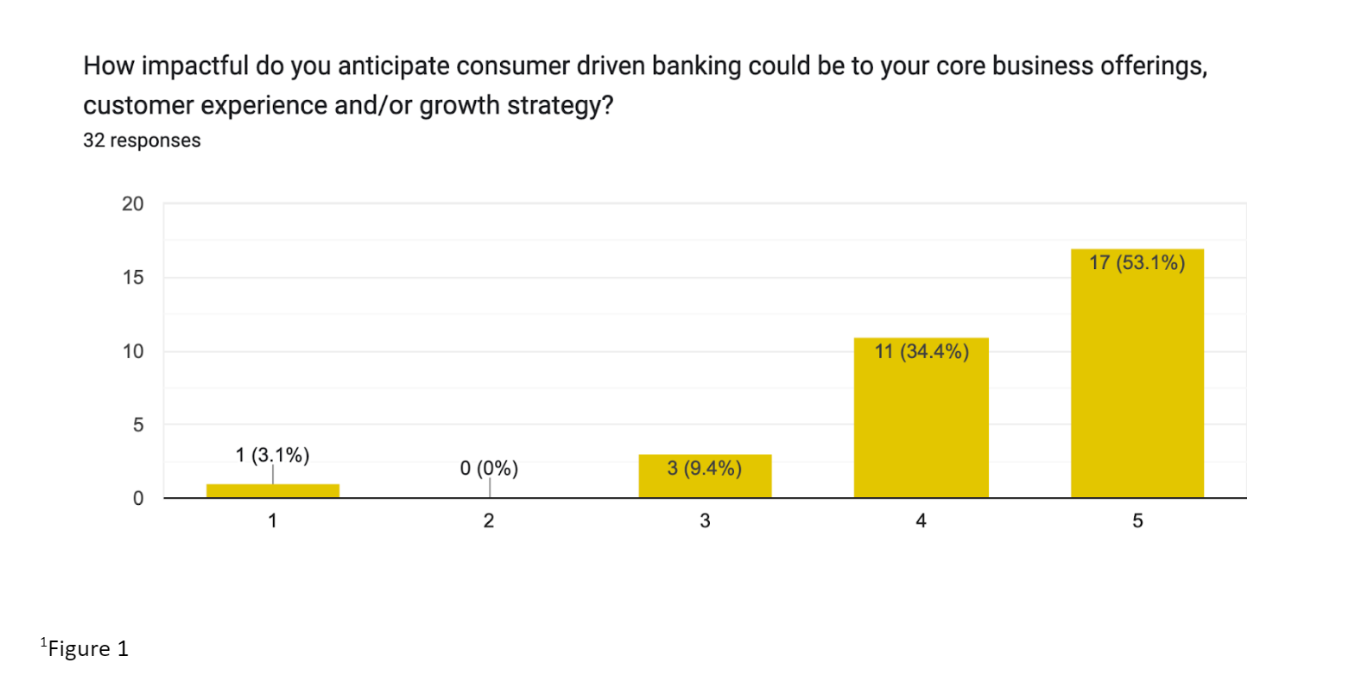

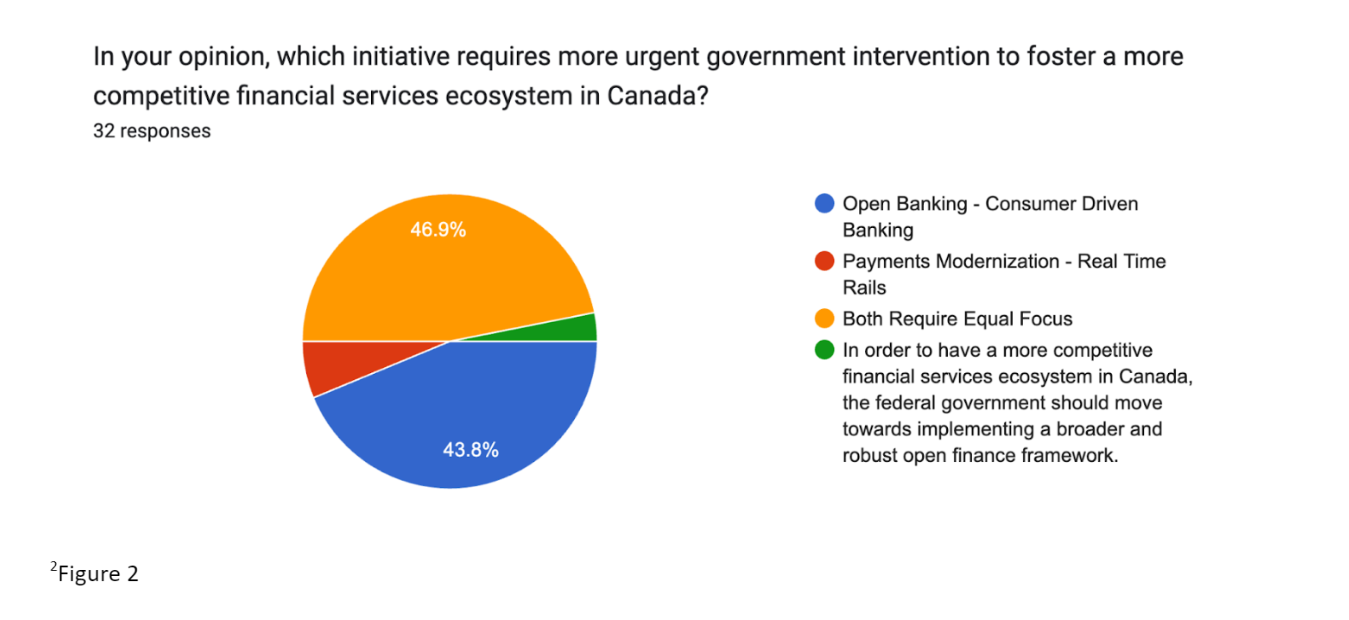

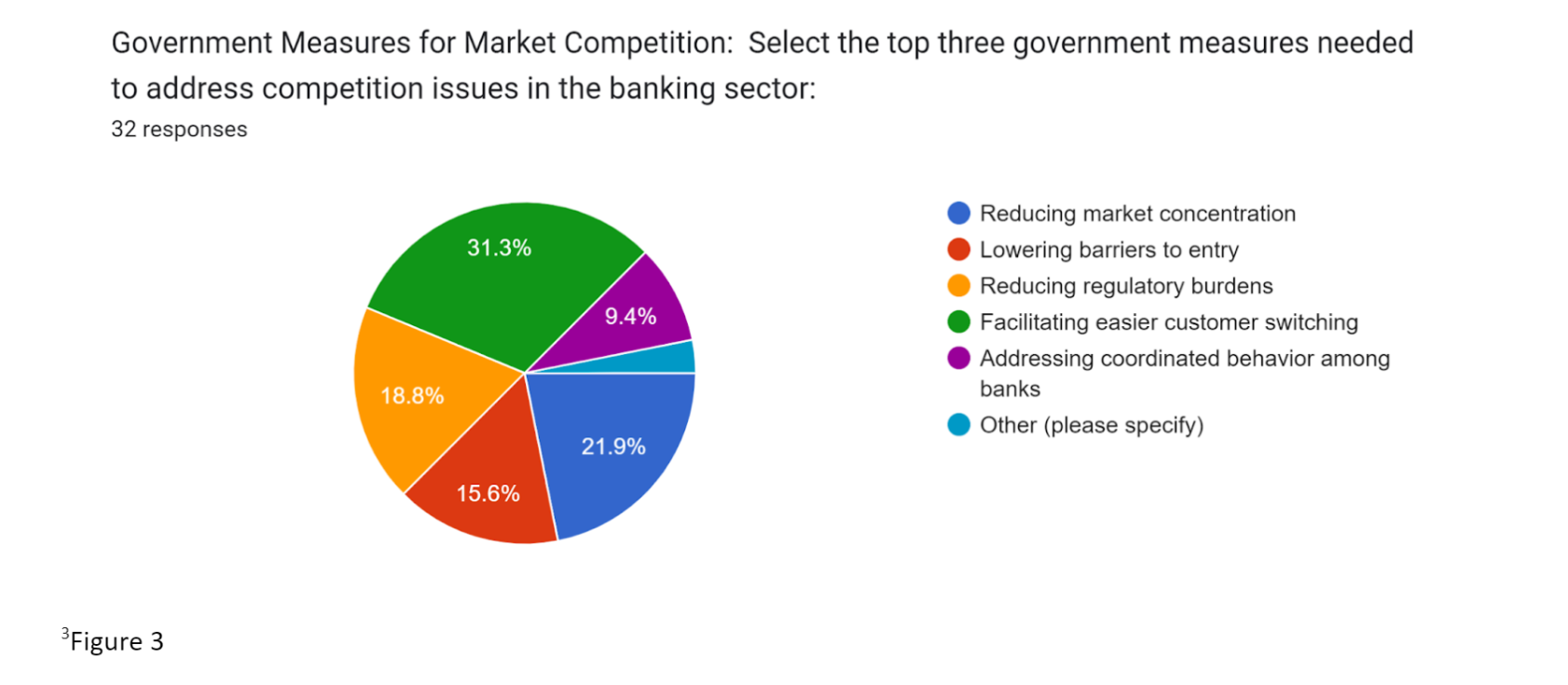

The CLA’s Open Finance Roundtable has conducted a thorough survey among its membership regarding their perspectives on open banking, and the insights garnered from this survey will be instrumental in shaping our submission. Our objective in administering this anonymized survey was to gain a comprehensive understanding of the viewpoints within the CLA community and, where feasible, present a unified stance on key topics. Circulated to our members in early February, the survey received responses from 32 companies, representing a diverse range of sectors including media, banking, card providers, consulting, and consumer reporting agencies.

While the CLA does include banks among its membership, the association does not advocate for the specific policy interests of these banks. As such, our response will concentrate on addressing questions related to open finance, rather than delving into matters concerning the current acquisition or merger process.

- What existing barriers do Canadian consumers face in accessing banking services?

The CLA acknowledges several existing barriers that Canadian consumers face in accessing banking services. Primarily, delays in the implementation of open banking have resulted in diminished convenience for borrowers, restricted choice, and reduced competition in the financial services sector.

Open banking offers Canadians transformative potential by providing the convenience of managing multiple bank accounts, tracking spending and investments, and planning their financial futures. Open finance builds upon these advantages by expanding the scope to include additional features such as real-time payments (RTR), consumer data rights and data portability, and common technology frameworks and data standards. According to a recent survey conducted by the CLA amongst its members, 87.5% of respondents said that consumer driven banking would be either Very Impactful or Extremely Impactful when asked “How impactful do you anticipate consumer driven banking could be to your core business offerings, customer experience and/or growth strategy?”

“87% of CLA Members believe Consumer Driven Banking would be VERY or EXTREMELY Impactful to their core business offerings, customer experiences and growth strategies.”

Rolling out a made-in-Canada open finance regime could significantly address these barriers and bolster competition in the financial sector. Open finance involves extending the principles of open banking beyond traditional banking products to include a broader range of financial services, such as lending, investments, and insurance. By enabling consumers to securely share their financial data with third-party providers, open finance promotes transparency, innovation, and consumer choice.

Members of the CLA’s Open Finance Roundtable believe that the rollout of a made-in-Canada open finance regime could address the following barriers within the financial sector:

Access to Financial Services: Open finance encourages the development of innovative digital solutions that cater to the needs of underserved or marginalized communities. Fintech startups and non-traditional lenders can leverage open finance platforms to offer alternative banking solutions tailored to specific demographics or geographic regions.

Costs and Fees: Competition resulting from open finance can exert downward pressure on fees and pricing, as fintechs and challenger banks introduce competitive pricing models and innovative fee structures. For example, lenders could offer low-cost or no-fee lending products targeting financially vulnerable populations who are disproportionately affected by high banking fees.

Consumer Choice and Customization: Open finance platforms empower consumers to compare financial products and services more easily, fostering a competitive marketplace where lenders must differentiate themselves based on product features, pricing, and customer experience. Consumers can access a wider range of lending options and tailor them to their specific needs and preferences.

Digital Literacy and Financial Education: As consumers engage more actively with new platforms made possible by open finance, they may develop greater digital literacy skills and financial knowledge. Fintech firms and lenders can leverage open finance initiatives to provide educational resources, tools, and personalized recommendations that empower consumers to make informed financial decisions.

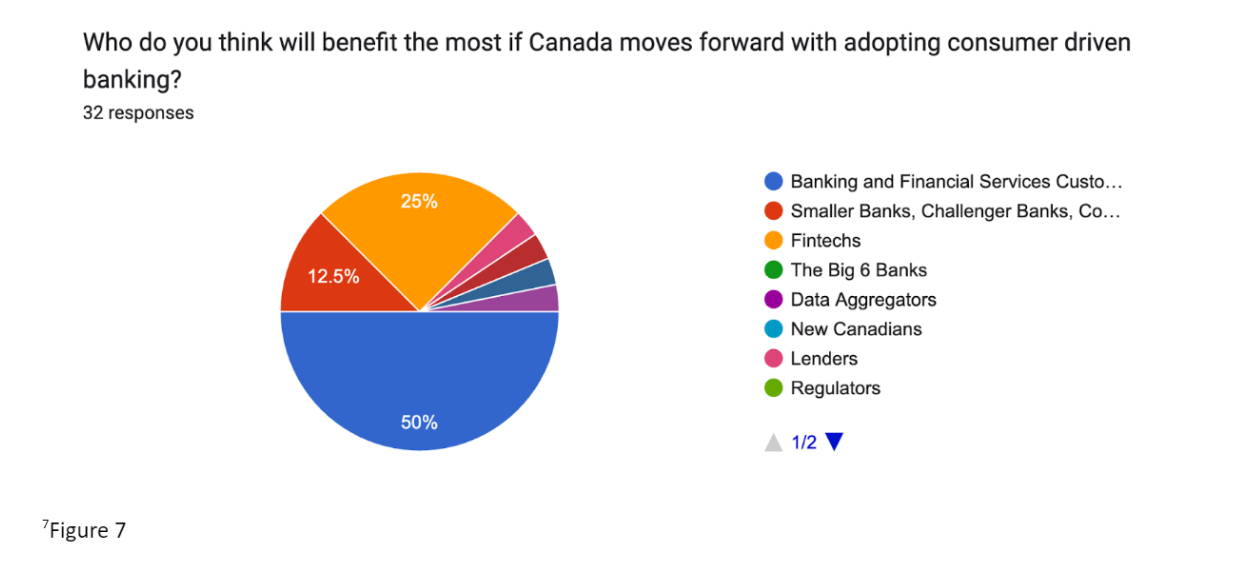

“The majority of CLA Members believe the adoption of Open Finance will benefit Canadian banking and financial services customers the most.”

Policymakers and regulators should consider how open finance initiatives can support a more competitive and inclusive financial ecosystem that benefits Canadian consumers and lenders alike.

- What measures would support a stronger tier of smaller, disruptive competitors (e.g., small- and medium-sized banks, credit unions, and fintechs)?

- What are the respective roles of the federal government, provinces, and territories? How could different orders of government work together more effectively to support smaller, disruptive companies?

- How can the federal government’s commitment to deliver Consumer-Driven Banking, also known as open banking, support competition in the financial sector?

“Over 90% of CLA Members agree that Consumer Driven Banking will enhance competition in the financial sector.”

The CLA’s Open Finance Roundtable advocates for regulatory frameworks that promote competition and innovation, leveling the playing field for smaller players. Measures such as streamlined licensing processes, access to standardized APIs (Application Programming Interfaces), and data-sharing agreements can empower smaller banks, credit unions, and fintechs to compete more effectively with larger incumbents. Additionally, investment in digital infrastructure and fintech incubator programs can provide vital support to smaller players, enabling them to develop innovative solutions and scale their operations.

Respondents to the CLA’s Open Finance survey claimed that the top three government measures that could strengthen competition were:

- Facilitating easier customer switching (31.3%)

- Reducing market concentration (18.8%)

- Alleviating regulatory burdens (15.6%)

This insight underscores the need for policymakers to prioritize initiatives that promote competition and innovation within the banking sector. By implementing these measures, regulators can foster a more dynamic and inclusive financial landscape, empowering consumers with greater choice and fostering an environment conducive to innovation and growth.

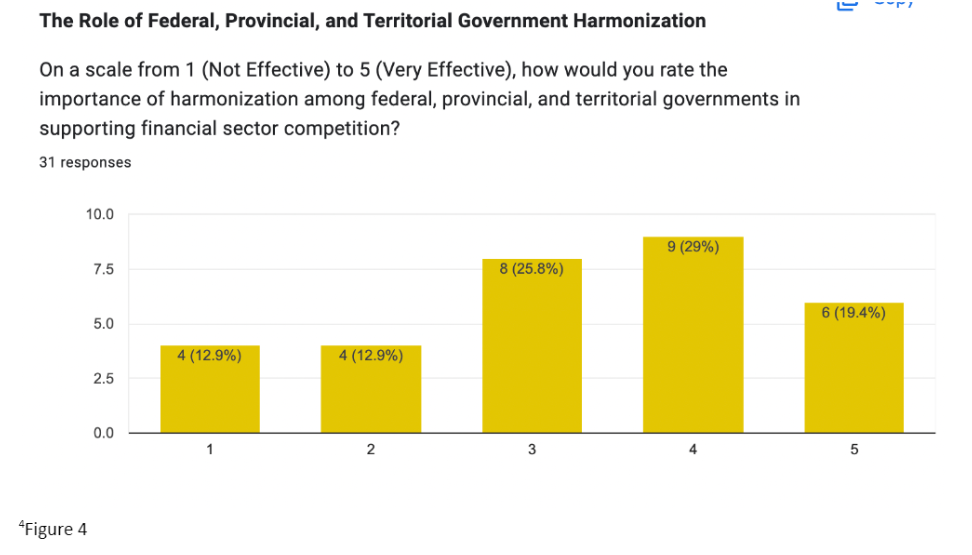

On the topic of provincial harmonization, the Canadian Lenders Association (CLA) asked, “On a scale from 1 (Not Effective) to 5 (Very Effective), how important is the harmonization between federal, provincial, and territorial governments in supporting competition in the financial sector?” The feedback showed mixed opinions, but most participants agreed that better coordination between provinces would be useful for setting up an open finance system. Despite varied views, there’s a clear majority that sees the benefit of aligning policies across different government levels to enhance competition in the financial sector.

The federal government also plays a crucial role in establishing overarching regulatory frameworks and standards for open banking, ensuring consistency and interoperability across provinces and territories. Provinces and territories, on the other hand, can contribute by implementing complementary regulations and initiatives that support smaller, disruptive companies within their jurisdictions. Collaborative efforts between different levels of government are essential to harmonize regulations, facilitate information sharing, and address jurisdictional complexities. By working together effectively, governments can create an environment conducive to the growth and success of smaller players in the financial sector.

Increased competition among financial service providers can drive down costs, improve product offerings, and enhance the overall customer experience. Additionally, a more fulsome open finance framework can promote financial inclusion by expanding access to affordable and innovative financial services (beyond just banking, payment and transaction information), benefiting consumers and smaller competitors alike.

- Could the framework better ensure a more level playing field for all participants to support competition?

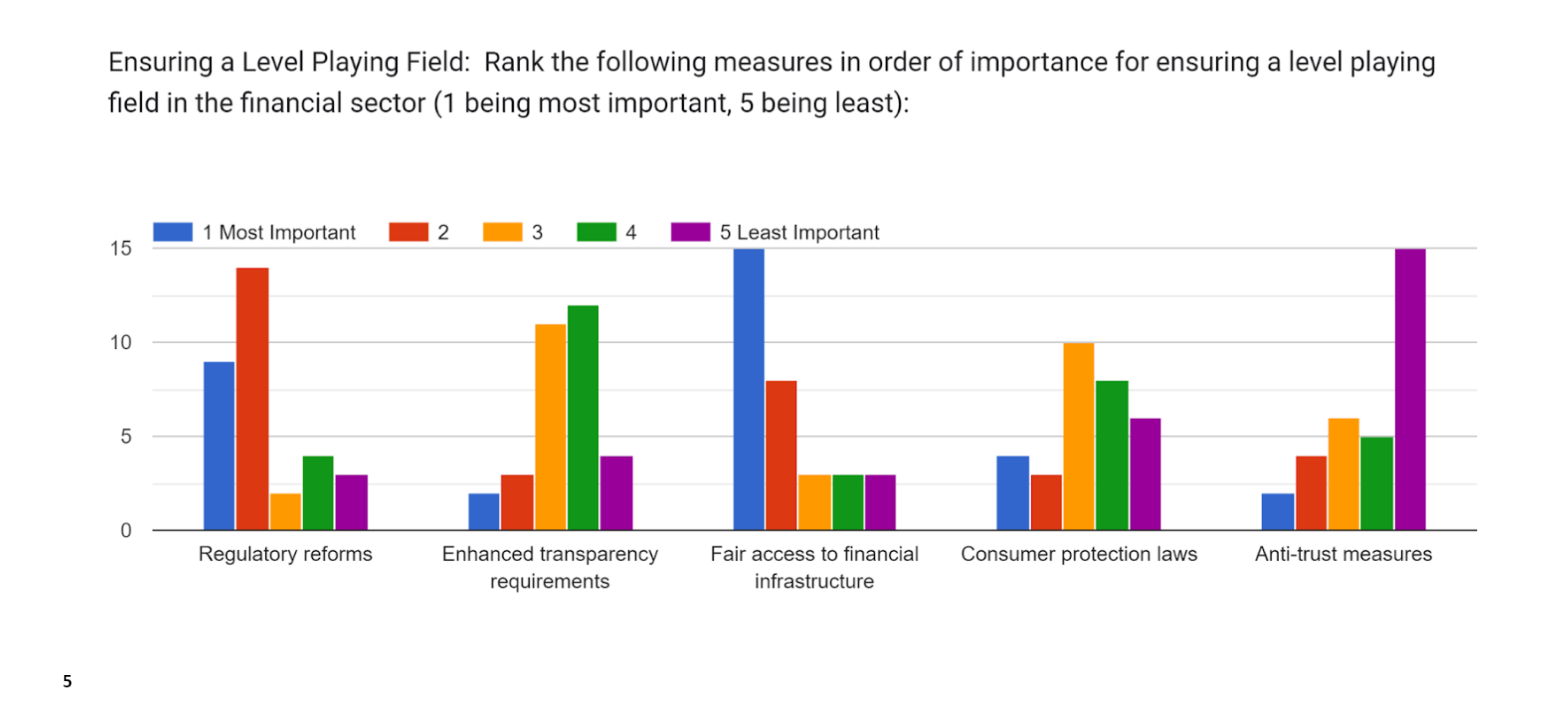

Establishing the framework to ensure a more level playing field for all participants in the financial sector is paramount to supporting competition. Standardizing regulations across the industry can prevent larger institutions from exploiting regulatory loopholes, while promoting transparency and accountability can foster fairness and informed consumer choices. Equitable access to essential infrastructure, such as payment systems and data-sharing platforms, is critical for preventing monopolization by larger institutions and enabling smaller players to compete. Furthermore, incentivizing innovation and fostering collaboration between fintech startups and established institutions can create opportunities for smaller, more agile competitors. By reducing red tape and streamlining regulatory processes, the framework can empower participants to compete more effectively, driving innovation and benefiting consumers and the industry as a whole.

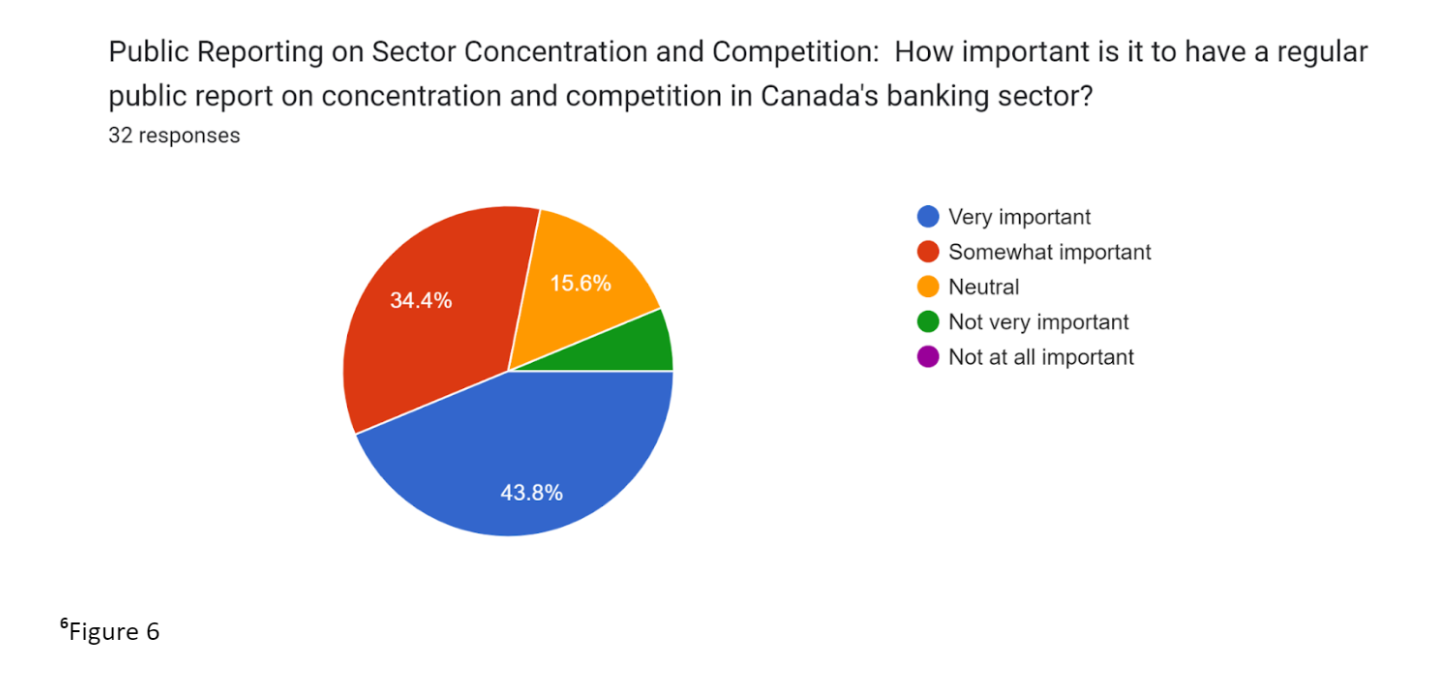

- Should there be a regular public report on concentration and competition in Canada’s banking sector? What would be important areas to consider in such a report?

As an association that represents fintech lenders advocating for increased affordability, innovation, and a level playing field for smaller competitors, we believe that there should be a regular public report on concentration and competition in Canada’s banking sector. Such a report is essential to promote transparency, accountability, and informed decision-making within the industry. Leveraging our years of expertise in releasing public reports based on primary research and data analysis, the CLA would be happy to partner with the government in helping to produce such a report.

In this report, it is crucial to consider various key areas, including the market structure, competitive landscape, and consumer accessibility of banking services. By analyzing market concentration, assessing competition among banks, and evaluating the availability of banking services, we can gain insights into the health and dynamics of the industry. Additionally, examining innovation, technology adoption, and regulatory environments will provide valuable information on the sector’s competitiveness and its ability to adapt to changing market conditions.

Moreover, focusing on financial inclusion efforts and systemic risks associated with concentration can help ensure that the banking sector serves the needs of all Canadians while maintaining stability. By benchmarking against international peers, we can identify best practices and areas for improvement, ultimately contributing to a more competitive and resilient financial system.

Overall, a regular public report on concentration and competition in Canada’s banking sector aligns with our goals of promoting affordability, innovation, and a level playing field for smaller competitors. However, we urge policymakers to prioritize its implementation after the rollout of open banking. This sequencing would ensure that the report can fully capture the impact of open banking on market dynamics, providing more comprehensive insights for effective policymaking.

- What measures to encourage competition could also support the creation of new jobs, and the protection of existing jobs, in the Canadian financial sector?

- What could be the potential implications for the Canadian financial sector workforce from your suggestions to the above questions?

Measures to encourage competition in the Canadian financial sector, particularly through initiatives like open banking and open finance, have the potential to support the creation of new jobs while also protecting existing ones. Embracing open banking and fostering competition among financial service providers can drive innovation in the sector, leading to an increased demand for skilled workers such as software developers, data analysts, and cybersecurity experts. Additionally, the expansion of the fintech ecosystem, spurred by increased competition, creates opportunities for job growth across various functions within these organizations, including product management, marketing, customer support, and compliance. As competition intensifies, there may also be a greater demand for professionals with expertise in areas such as customer relationship management, financial advising, and risk management. However, it’s essential to acknowledge that these changes may also result in job displacement for workers in roles that become redundant due to automation or shifts in business models. To mitigate these challenges, policymakers and industry stakeholders should prioritize reskilling and upskilling initiatives to ensure that the workforce remains adaptable and equipped with the skills needed to thrive in an evolving industry landscape. Additionally, proactive measures should be taken to support affected workers through transition assistance programs and career counseling, facilitating their successful reintegration into the workforce. By fostering a competitive and innovative environment while also investing in the skills and well-being of the workforce, the Canadian financial sector can position itself for sustainable growth and continued prosperity.

CONCLUSION

In conclusion, the CLA’s Open Finance Roundtable advocates for a regulatory environment that fosters competition, innovation, and affordability in the banking sector. Central to this vision is the urgent adoption of open banking standards, which members of the CLA’s Open Finance Roundtable view as essential for promoting transparency, consumer choice, and financial inclusion. We emphasize the need for government-led action to roll out a made-in-Canada open finance regime, which would address existing barriers to accessing banking services and bolster competition. Additionally, the CLA’s Open Finance Roundtable calls for collaborative efforts between different levels of government to support smaller, disruptive companies and ensure a level playing field in the financial sector. Through this consultation submission, the Roundtable underscores its commitment to advancing the interests of the financial sector and promoting a more prosperous and inclusive ecosystem in Canada.

Figure 1: Which initiative requires more urgent government intervention to foster a more competitive financial services ecosystem in Canada? Data from a survey conducted by the Canadian Lenders Association. February, 2024.

Figure 2: Which initiative requires more urgent government intervention to foster a more competitive financial services ecosystem in Canada? Data from a survey conducted by the Canadian Lenders Association. February, 2024.

Figure 3: Government Measures for Market Competition. Data from a survey conducted by the Canadian Lenders Association. February, 2024.

Figure 4: The Role of Federal, Provincial, and Territorial Government Harmonization. Data from a survey conducted by the Canadian Lenders Association. February, 2024.

Figure 5: Ensuring a Level Playing Field. Data from a survey conducted by the Canadian Lenders Association. February, 2024.

Figure 6: How important is it to have a regular public report on concentration and competition in Canada’s banking sector? Data from a survey conducted by the Canadian Lenders Association. February, 2024.

Figure 7: Who do you think will benefit the most if Canada moves forward with adopting consumer driven banking? Data from a survey conducted by the Canadian Lenders Association. February, 2024.