Lowering Maximum Allowable Rate of Interest Will Hurt Millions of Canadians, says CLA

OTTAWA – The Canadian Lenders Association (CLA) is disappointed at today’s announcement to lower the maximum allowable rate of interest to 35 per cent from a 47 per cent Annual Percentage Rate (APR).

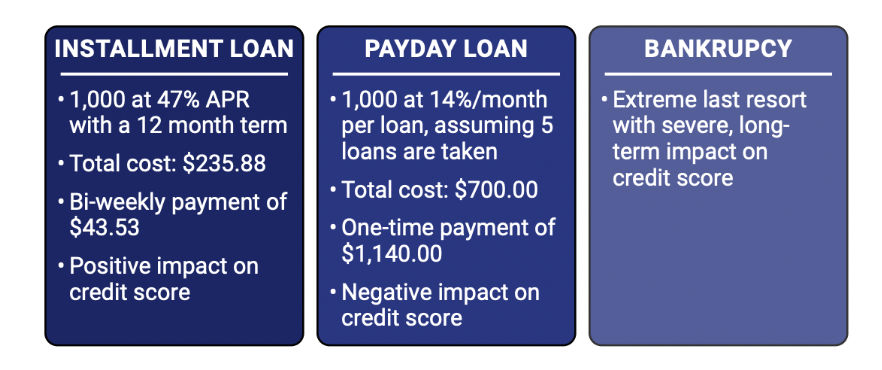

The CLA, which represents members across the lending spectrum in Canada, acknowledges making life more affordable for Canadians is a goal worth pursuing. This measure, however, will do precisely the opposite, making life more expensive for some 4.8 million Canadians by eliminating their access to non-prime credit. As a result, many may be forced into payday loans of up to 600 per cent.

The CLA put considerable effort into informing the federal government of these unintended consequences and is disappointed this reality is not acknowledged by today’s announcement. See CLA submission on the adverse effects of lowering the maximum interest rate.

“This will disproportionately affect low-income Canadians – the segment of the population most at risk given their inability to qualify for credit at prime rates – who struggle to make ends meet by limiting or eliminating entirely their access to credit,” said CLA president and CEO, Gary Schwartz.

“In an effort to ease the financial burden on Canadians who need it most, the federal government has achieved the opposite. If you are borrowing at non-prime, you are already facing financial challenges. For potentially millions of Canadians, that burden just got heavier today.”

Historically, government and consumer advocacy groups have tended to conflate the payday loan industry with the alternative loan market. The definition of “payday loan” under the Payday Loans Act, 2008 is extremely broad and could inadvertently catch many products that do not warrant regulation as payday loans. In particular, installment lending is often mistakenly grouped together with payday lending in the media and with some policy markers because these types of loans can share certain features, like low principal amount of credit extended over a short term. Installment lending can provide creative and alternative lending options that benefit consumers while still being subject to regulation under both the Code and provincial consumer protection regimes.

The APR formula featured in the graphic below yields a straightforward interest rate of 47% APR based on the total interest paid and the initial loan amount. However, an essential nuance to recognize is that this interest rate is applied to a diminishing loan balance over the course of the year.

Here’s a breakdown of why we don’t observe the expected $470 in interest with a 47% APR:

- The loan begins at $1,000.

- As the borrower makes payments, a portion of each payment is allocated towards reducing the principal balance. This gradual reduction in the principal occurs over time.

- With each payment made, the interest is calculated based on the remaining balance, which diminishes due to the borrower’s prior payments.

If the government seeks to make life more affordable for Canadians, the focus needs to be on the predatory payday lending sector. The time gap between today’s announcement and any eventual action could leave millions of Canadians without access to non prime credit, and reduced competition in the lending market.

The CLA will continue to work with the federal government as it implements this measure and contemplates further action. It is essential that we together ensure any measures taken in the lending sector achieve their intended goal of easing the financial burdens on Canadians who need it most.

For media inquiries, please contact:

Chisholm Pothier

CLA media relations

chisholm@canadianlenders.org

613-325-2555