November is Financial Literacy month, and one important but often-overlooked demographic in need of financial literacy is the under-18 crowd. Kids who learn the value of money and how to appropriately manage their finances are likely to grow into responsible and independent adults. The vast majority of schools, however, don’t have any educational infrastructure in place to support this type of learning. Sure, the Pythagorean theorem can be beneficial to grasp, but why aren’t topics like how to appropriately manage a budget and navigate a banking interface part of most schools’ curricula?

Enter into the equation a wide range of family-friendly financial literacy apps. The services provided run the gamut from digital bank accounts, digital wallets, smart cards, as well as allowance allocation and chore scheduling features. Most link to a parents’ bank account and include safety valves to ensure against reckless spending.

One such app was developed by RBC Ventures. Mydoh connects to a Smart Cash Card (which works like a debit card) powered by Visa. Mydoh is available to customers of all Canadian banks but costs an added $2 per month to non-RBC accounts. Ostensibly, apps like these can see an individual through all their life stages, eventually providing credit extension through RBC.

Many of these apps have a gamified approach, which might appear to denigrate the seriousness of financial decision making. However, this is mitigated in large part since gamification is ubiquitous, even for adults: instant gratification through social media “likes,” or racking up “points” through retail orders. Further, getting kids interested in finance can be a challenge. “There needs to not only be a long term reward but also something short term to show them the benefits of what you’re offering,” says Rim Charkani, co-founder and CEO of WALO. “That’s where gamification in the experience is key.”

Charkani co-developed WALO, the successful FinLit app, to provide an educational layer on top of Canadian bank accounts that allows parents to plug in a kids’ account and teach them about money. Its developers brought it to market after realizing that banks have missed out on the millennial milieu, and are now missing out on Gen Z by not providing a meaningful value-add and relevant banking experience in their product offerings.

Treasure, founded in Toronto, also provides a debit card and gamified approach to money management for kids. Its founders agree that traditional bank offerings don’t typically provide adequate products for kids to learn how to grow up and be good with money.

Consumer Demand

The high demand for these products comes not only from concerned parents, but from teens and young adults themselves. In a report by the British Columbia Securities Commission, 93% of recent high school graduates agreed it is important to learn about finance at an early age and to build up personal savings. However, nearly 4-in-10 (38%) admitted they didn’t know how much they earned and spent in the previous month.

Even though they might not keep track of their earning and spending, Canadian students are ahead of the game —they rank higher in financial literacy than the international average, according to a recent assessment by the Organization for Economic Co-operation and Development (OECD). The federal government also provides resources to encourage financial literacy—the Financial Consumer Agency of Canada (FCAC) has a web page entitled, “Teaching children about money.” Still, most of the resources provided in schools (if any) or by the FCAC are not up-to-date with consumer trends or relevant developments in digital banking.

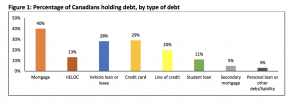

Canadian school children who might eventually take out loans for higher education—a significant portion of the population—need apps like these even more. 11% of Canadians currently hold student loan debt, with the average cost of post-secondary education currently topping $80,000.

Source: Financial Consumer Agency of Canada

Perhaps if intervention had been made in earlier life stages, the landscape of student loan debt might look different today.

Market Assessment

In the U.S. and the U.K this space is crowded with many players. In Canada, there’s nothing like that yet, which makes it an exciting time, according to Rim Charkani. “The timing is right from a maturity perspective of the market,” explains Charkani. “Fintech adoption is growing in Canada and the market is now ready to adopt these kinds of solutions.”

Canadian youth are already a highly financially literate demographic subset, and have indicated a desire to learn more. Thus, they are perfectly positioned to be receptive to the support provided by these apps. And parents could use some external support, too: in a survey last month by TD Bank, 33% of Canadian parents indicated they’re not confident they’re setting a healthy financial example for their kids.

Digital banking is making people more knowledgeable about their finances; fintechs are bringing a diverse set of people into the financial ecosystem. The most successful apps aimed at early childhood financial literacy will help teach the financial language to the next generation, and inspire the next innovators.