Explaining Why the APR Cap Matters!

Over the past two years, I have worked closely with our non-prime lender community, huddled with stakeholders in Ottawa, run national polls, consulted with law enforcement and thousands of borrowers. After hundreds of hours of discussing the consequences of using the Criminal Rate as a tool to reduce the APR, I can tell you that few understand what is at stake or why this is even an issue.

I want to explain in the simplest of terms why this policy is bad for consumers trying to access credit and build their credit score. Please read and share.

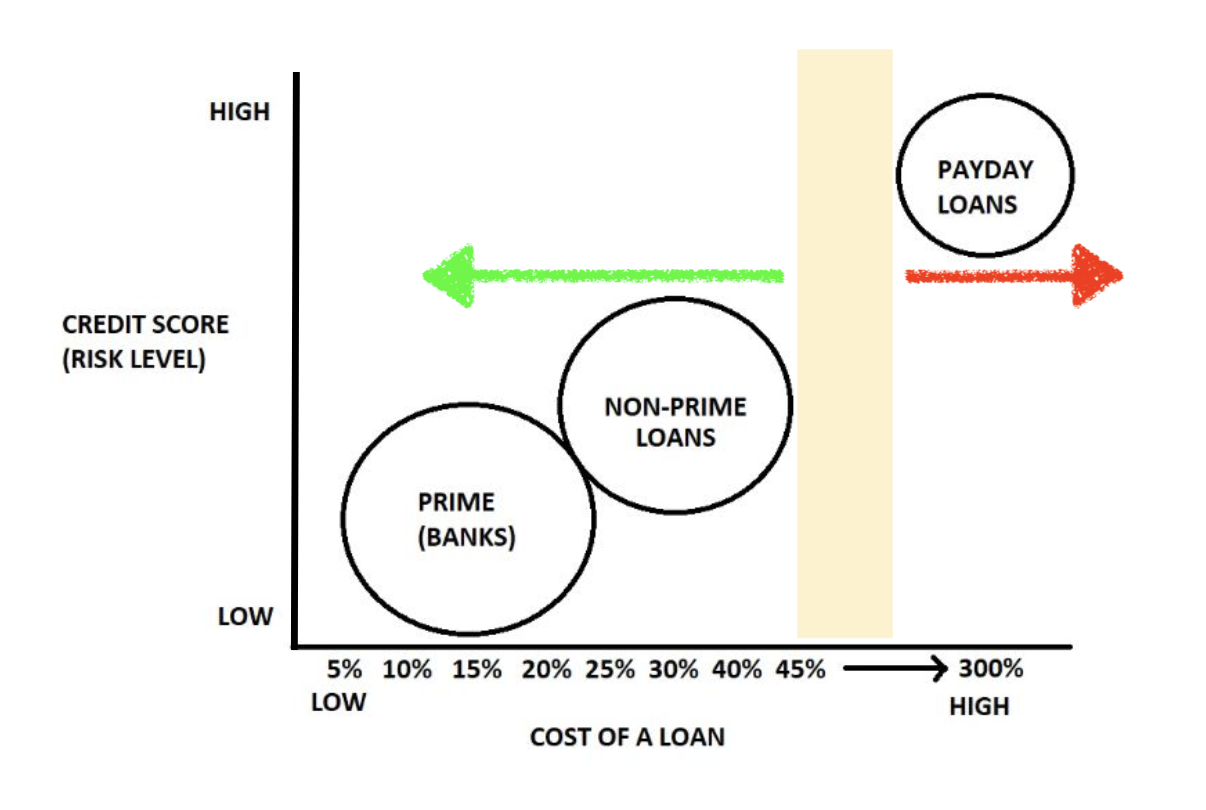

Existing State of Lending

The instalment lending ecosystem is a continuum. There are lenders that service prime and there are lenders that service non-prime. A borrower that has a lower credit score cannot walk into a prime lender as that lender will not be able to lend to this borrower based on their credit risk. Although the prime and non-prime lenders service different borrowers, they share a goal of reporting repayment to the credit bureaus and building the credit scores of Canadian borrowers.

Just as car insurance companies charge more to insure a newly licensed driver or someone who has been in an accident, lenders must account for borrowers with no credit history, or a low credit score. Although Canadian with a low credit score or new-to-Canada with no credit history may need to take a smaller loan at a high interest rate, more than 9 out of 10 these non-prime borrowers repay their loans and graduate to more cost effective rates.

Conversely, borrowers that use payday and other predatory lenders are stuck in a debt trap that they cannot graduate from.

The Lending Credit Desert

Between instalment lenders and payday and predatory lenders there is a Credit Desert. Even at 47% APR many Canadian borrower cannot get credit because the calculated risk is too high for the lender. Borrowers that have an immediate need for credit for car repair or an illness in the family are forced to work with payday lenders at a significantly higher APR than the criminal rate of 47% (before the recent reduction to 35% APR). Payday lenders will offer 300% APR and higher.

It gets worse. Because these are short-term loans that are capped at $1500, borrowers often need to manage 2 or 3 loans in parallel over many cycles of renewal. The most financially literate person would find this challenging.

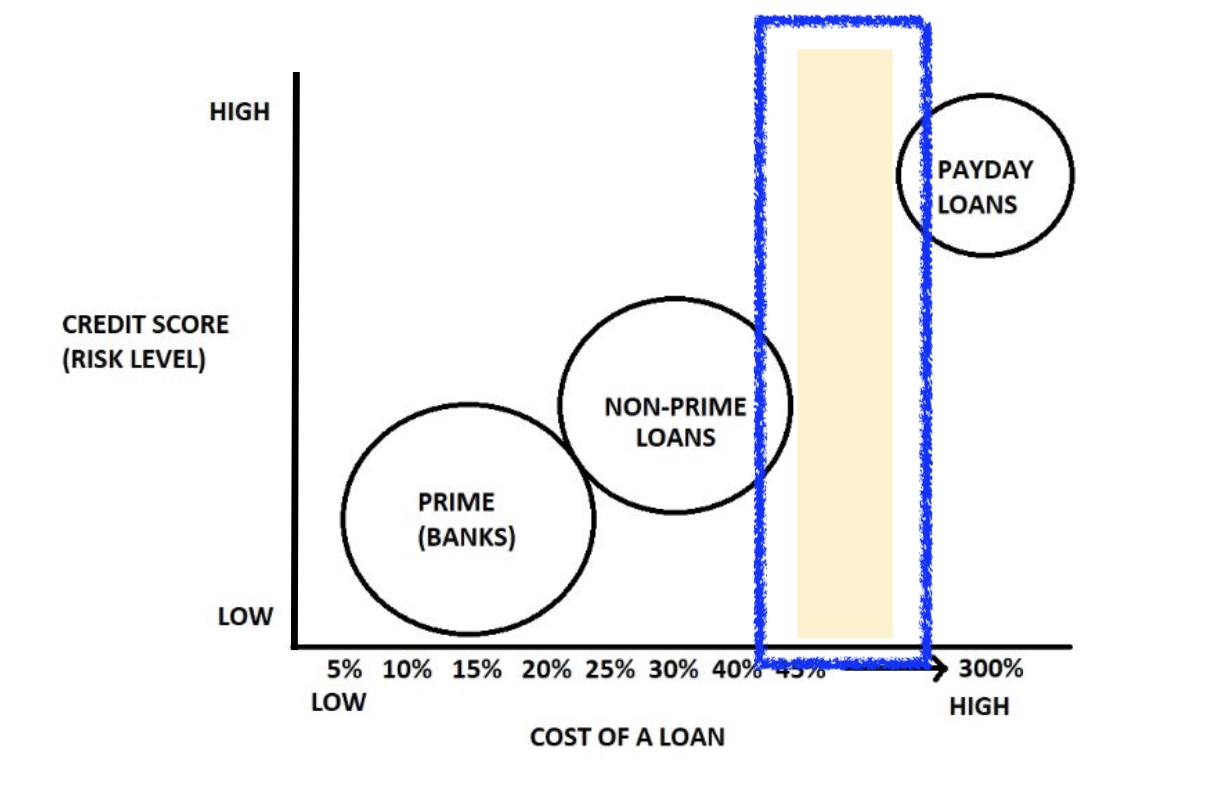

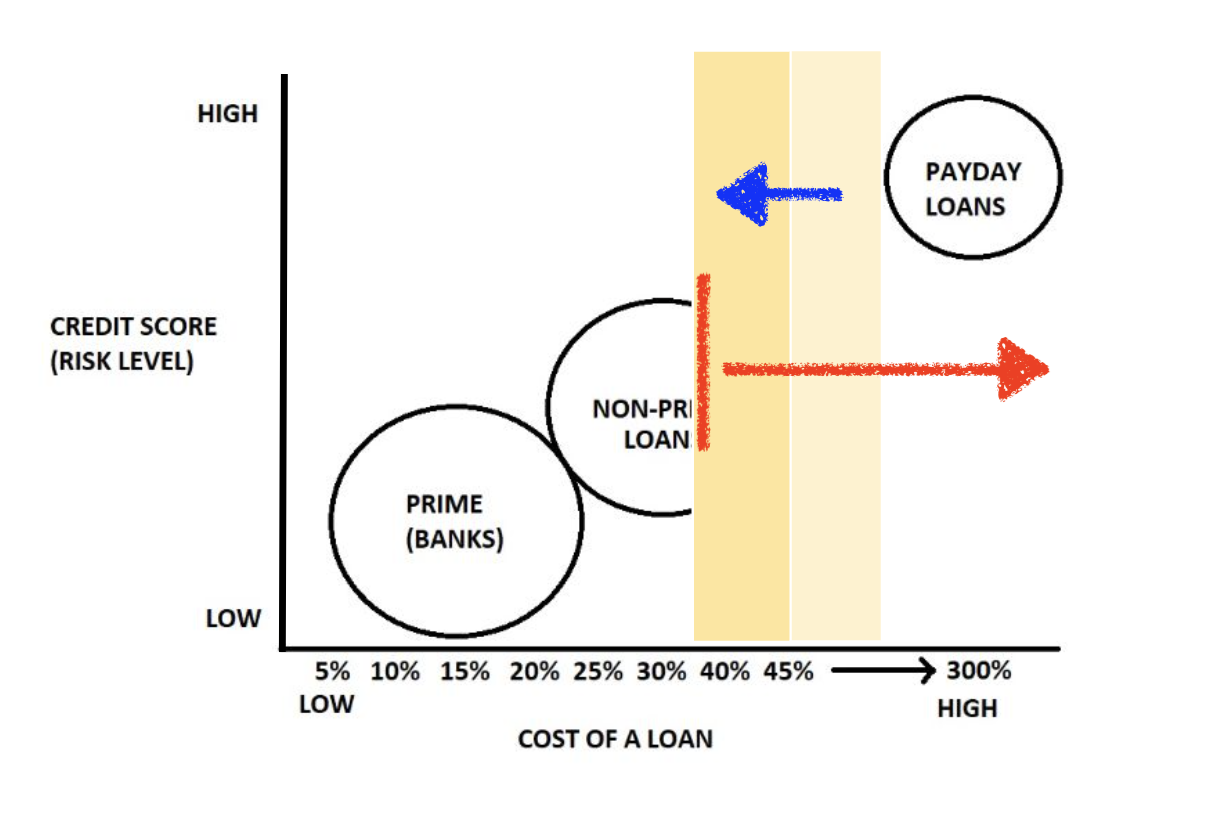

Government Expanding the Credit Desert

With the reduction in the maximum rate of interest from a 47% cap to a 35% cap, the government is now expanding the credit desert for the most marginalized non-prime borrowers. The new credit desert is now twice the size meaning that upward of 4.7 million Canadians will now only have payday and other predatory options. Bad actors will enter the market to service this need. Please read the OAPC report. Our GDP will be negatively impacted. Please read the EY market impact report. And lenders will exit the market leading to reduced competition.

We need Canadians to have access to credit that they can repay and graduate their credit score. By repaying a small loan at a high APR, the borrower quickly builds their credit score and moves to better rates. We need a healthy ecosystem to service all Canadians.

Do not break consumer lending in Canada!