Breaking the Margin Squeeze in Canadian Auto Finance:

Why AI-Based Pricing Is Ready for Prime Time

Abstract: Canadian auto lenders are trying to hold margin in a volatile, dealer-driven market that still runs on monthly rate sheets. That operating model is too slow, too blunt, and too easily gamed by incentives that are not tied to risk. The pragmatic fix is analytical, risk-aligned pricing that uses AI to simulate outcomes, set prices with precision, and shorten decision cycles from months to days. This is not a black box and not a rip-and-replace. It is a controlled upgrade that aligns pricing with credit, protects dealer relationships, meets fairness expectations, and delivers measurable lift in booked yield and quality mix. The data already lives in your loan origination system. The leaders who move first will get their basis points back.

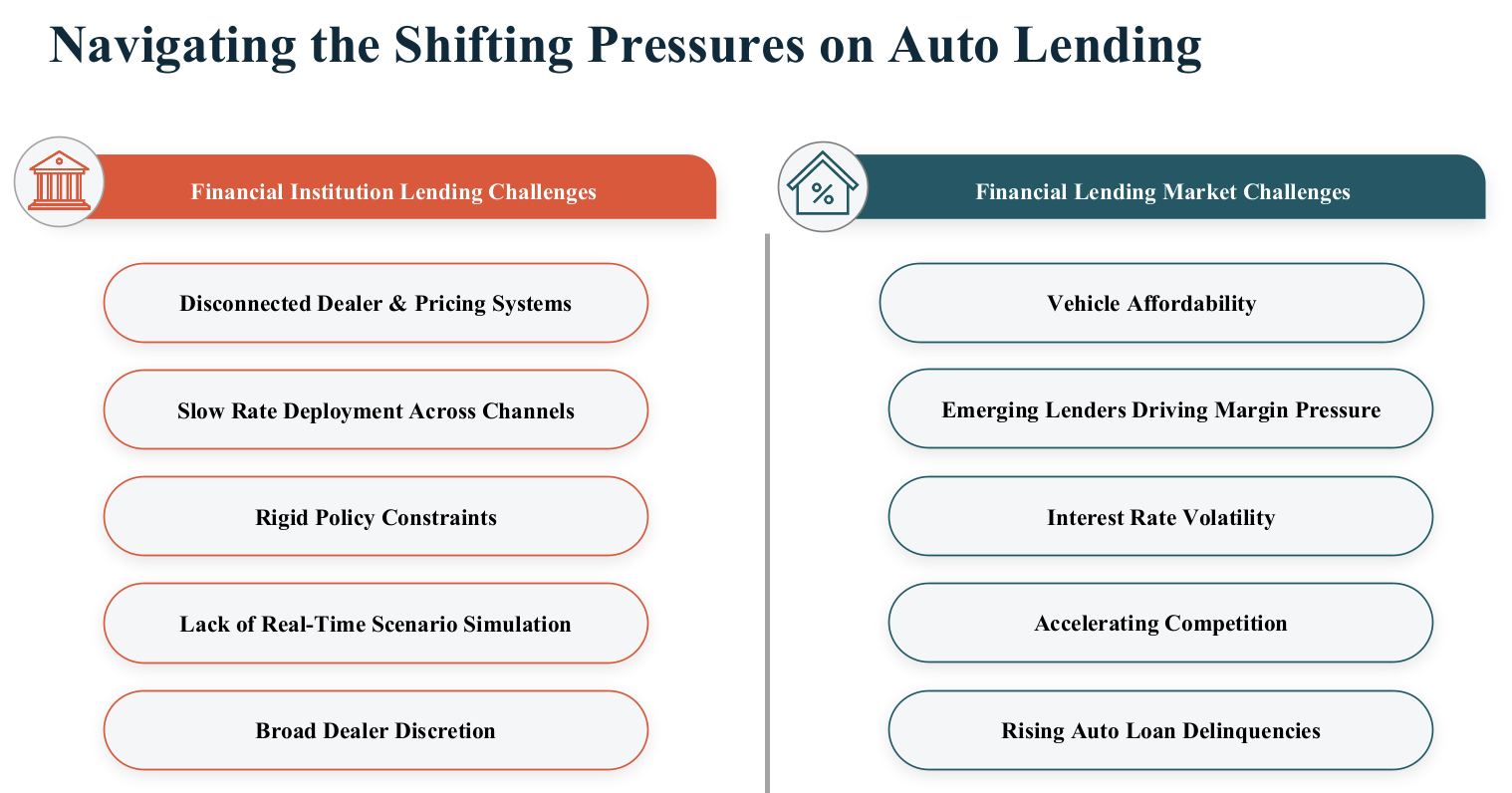

Canadian auto lenders are living in a pressure cooker. Borrowing costs move on headlines, vehicle prices remain high, affordability is tight, and dealers protect their compensation with wide rate discretion. Margins get squeezed, incentives grow heavy, and static pricing practices are left chasing a market that changes by the week.

Here is the uncomfortable truth. Many lenders in Canada still prices like it is 2012. Most institutions publish a rate sheet once a month, execute mid-month patches when bond yields jump, and hope volume and dealer relationships smooth the edges. Grids are complex, often inconsistent, and rarely calibrated to the true risk of the deal in front of the desk. This is a legacy operating model that survived while spreads were fat. That cushion is gone.

The question is not whether to modernize. The question is how to do it without breaking dealer trust or inviting regulatory problems. The answer is analytical, risk-aligned pricing supported by AI and machine learning. Not sci-fi. Not a wholesale replacement of the relationship at the point of sale. A practical operating upgrade that adapts proven global practice to Canadian realities.

Start with cadence. A monthly rate sheet is slow by design. Bond yields jump, competitors move, and macro signals do not wait for a product committee. Once a static sheet hits the field, booked yield drifts away from plan. Product teams scramble, leadership approves mid-course edits, and everyone spends more time reacting than shaping outcomes.

© Earnix

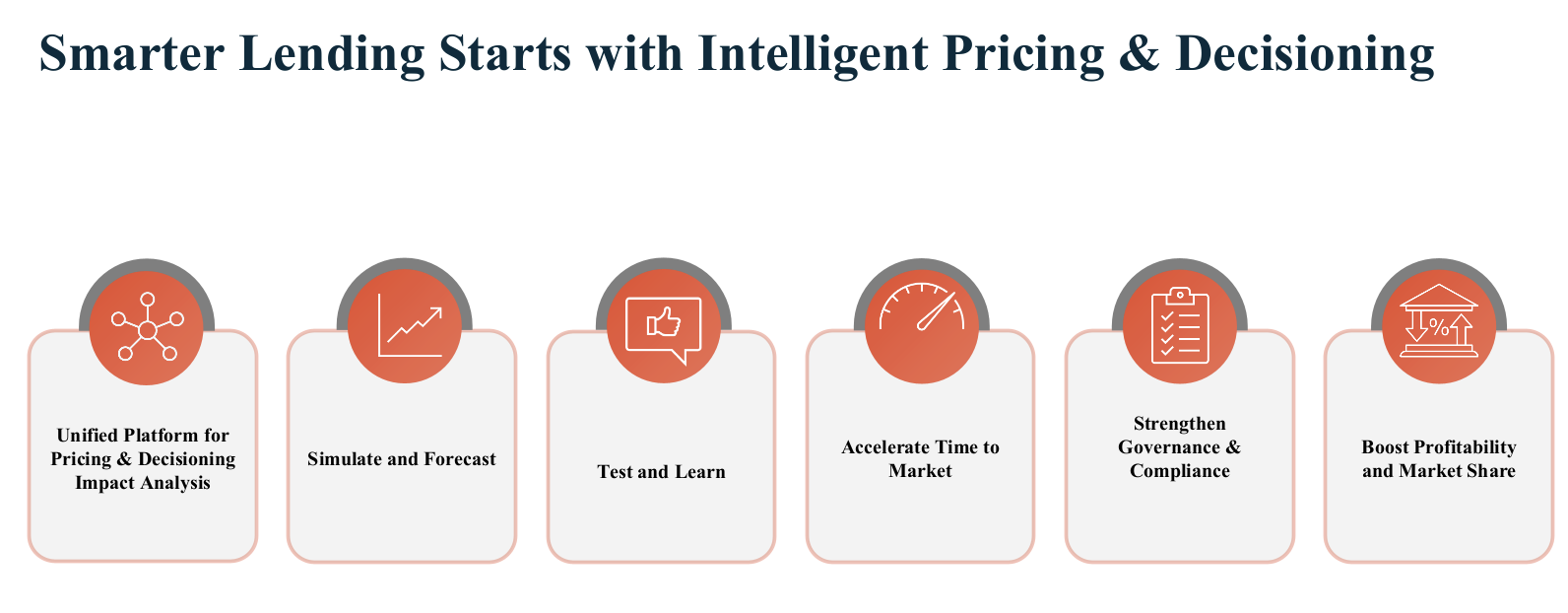

Forecast, in minutes. AI-based pricing reverses that posture. Instead of guessing, lenders simulate. A unified platform ingests portfolio history, recent application flow, and market intelligence. It then forecasts, in minutes, how a proposed change will affect booking probability, net interest margin, credit cost, and dealer reserve by segment and region. After deployment, the same platform monitors outcomes, compares them to forecast, and prompts the next adjustment. Decision cycles compress from months to days, sometimes to hours when conditions demand.

Mispricing. There is another benefit that hides in plain sight. Risk-aligned pricing exposes mispricing at both ends. Every lender knows the high-risk deals that were overcompensated. Fewer quantify the prime deals they lost because the comp was a notch too thin. Simulation makes the trade-offs visible. It shows where a small increase in dealer compensation secures high-lifetime-value customers, and where tightening prevents overpayment on marginal paper. Even inside today’s dealer-led structure, this creates lift without a subsidy war.

What about data. Leaders often assume the journey stalls here. It does not. You do not need a multi-year data expedition to get started. For demand and price elasticity models, the essential feed already sits in your loan origination system. Who applied, who was approved, what price was quoted, and who booked. Six months of that, refreshed weekly, is usually enough to build a reliable view of customer and dealer sensitivity to price. Unlike credit loss models that wait for defaults to season, elasticity appears as soon as customers say yes or no.

Will this damage dealer relationships? It should do the opposite. Analytics help lenders work in the market we actually have. Dealers expect discretion. Lenders expect predictability. Granular comp grids that are tied to objective risk tiers and observed booking behavior create clearer rules of the road. The result is not less autonomy at the desk. It is more transparency about what each lever delivers for all parties.

Fairness and explainability matter. Canada’s posture is evolving, and lenders should act like tomorrow’s rules arrive today. Modern pricing platforms use supervised learning. Inputs are visible, policies govern changes, and every decision is logged for audit. Two years from now, if you must explain why Customer A received 10 percent and Customer B received 12 percent, the answer lives in one place with traceable logic and versioned models. The biggest black box in pricing is often the human. Analytics make the human decision better rather than hiding it.

Is changing processes difficult? Change only feels overwhelming if leaders try to do everything at once. The most successful teams start small and build from there. Begin by moving your current pricing process onto the new platform. Then, step by step, add more insight — first by understanding how customers respond to price changes, then by linking pricing and credit decisions so they work together. Next, refine dealer incentives where the data shows the biggest gains. Train your teams both on how to use the tool and how to apply it strategically. Celebrate small wins that improve results, and use those to build momentum for bigger changes. It is an iterative process.

© Earnix

What should you measure? Start with how much your margins improve — that’s the main result. Then look at how many loans you’re booking by risk level and region to see what’s really driving performance. Track credit losses and fairness to make sure the system stays balanced. Finally, measure how quickly your team can make and adjust decisions. If those times get shorter, it means your pricing and risk teams are working better together. The goal isn’t just more data — it’s helping people collaborate, test ideas, and act faster.

Canada vs. the World. Canada doesn’t need to copy other markets to improve. But lenders do need to move beyond monthly rate sheets. The economy changes every day, not once a month, and pricing should reflect that. Lenders that adapt faster will price risk more accurately, win more quality deals, and strengthen dealer relationships through clearer, quicker decisions.

Agentic Solutions are Normalizing. There is a wider point beyond this year’s squeeze. AI is not the headline. It is the plumbing. Soon we will stop saying AI pricing and just say pricing. The waterline of normal practice will rise, and the label will drop.

The Canadian Lenders Association will carry this forward at Automotive Finance Canada 2026 in February. Expect deeper dives on simulation, governance, and the connection between pricing and credit decisioning. Expect case studies on how lenders tuned dealer incentives with precision and won share without starting a subsidy war. Expect practical workshops that shorten the distance between analysis and action.

The industry isn’t standing at the edge of a cliff — it’s standing at a crossroads. Canadian lenders have an opportunity to evolve from traditional, rate-sheet-based practices toward a more agile, insight-driven approach that reflects today’s dynamic market. The tools exist, and the data needed to unlock value is already in-house. This isn’t about a revolution on the showroom floor — it’s about thoughtful modernization, guided by leadership that recognizes pricing as a strategic advantage rather than an administrative task.

Every basis point still matters, but now lenders can earn those gains through clarity, testing, and responsiveness. The organizations that embrace analytical, risk-aligned pricing will move with the market instead of against it — building stronger dealer relationships, fairer outcomes for consumers, and more sustainable profitability. That’s how Canadian auto finance can move forward with confidence and reclaim its margins for the next era of growth.

Top 10 Takeaways for Lenders

- Move from monthly to continuous. Static rate sheets are too slow for today’s volatility. Use simulation to plan and monitor changes in near real time.

- Price to risk at deal level. Granularity in both rate and dealer compensation reduces overpayment on weak paper and prevents losing prime deals.

- Start with the data you already have. Approvals, quoted price, and book or no-book outcomes are usually enough to model demand sensitivity.

- Unify pricing and credit decisioning. Align models and workflows so risk estimates and price actions speak the same language.

- Treat dealers as partners, not obstacles. Transparent, risk-tied comp grids protect dealer autonomy while improving predictability for lenders.

- Build supervised, auditable models. Ensure every input, rule change, and outcome is logged, explainable, and ready for scrutiny.

- Train for tools and tactics. Teach teams how to operate the platform and how to use it to compete, including when to change strategy.

- Measure what proves lift. Track booked margin, conversion by segment, net credit loss, fairness indices, time to decision, and change cycle time.

- Scale through iteration. Recreate today’s process in the platform, add one sophistication at a time, and bank quick wins to build momentum.

- See you at the Auto Finance Summit. Bringing pricing, risk, and dealer teams together in February for case studies, governance frameworks, and hands-on practice that shortens the path from analysis to action.