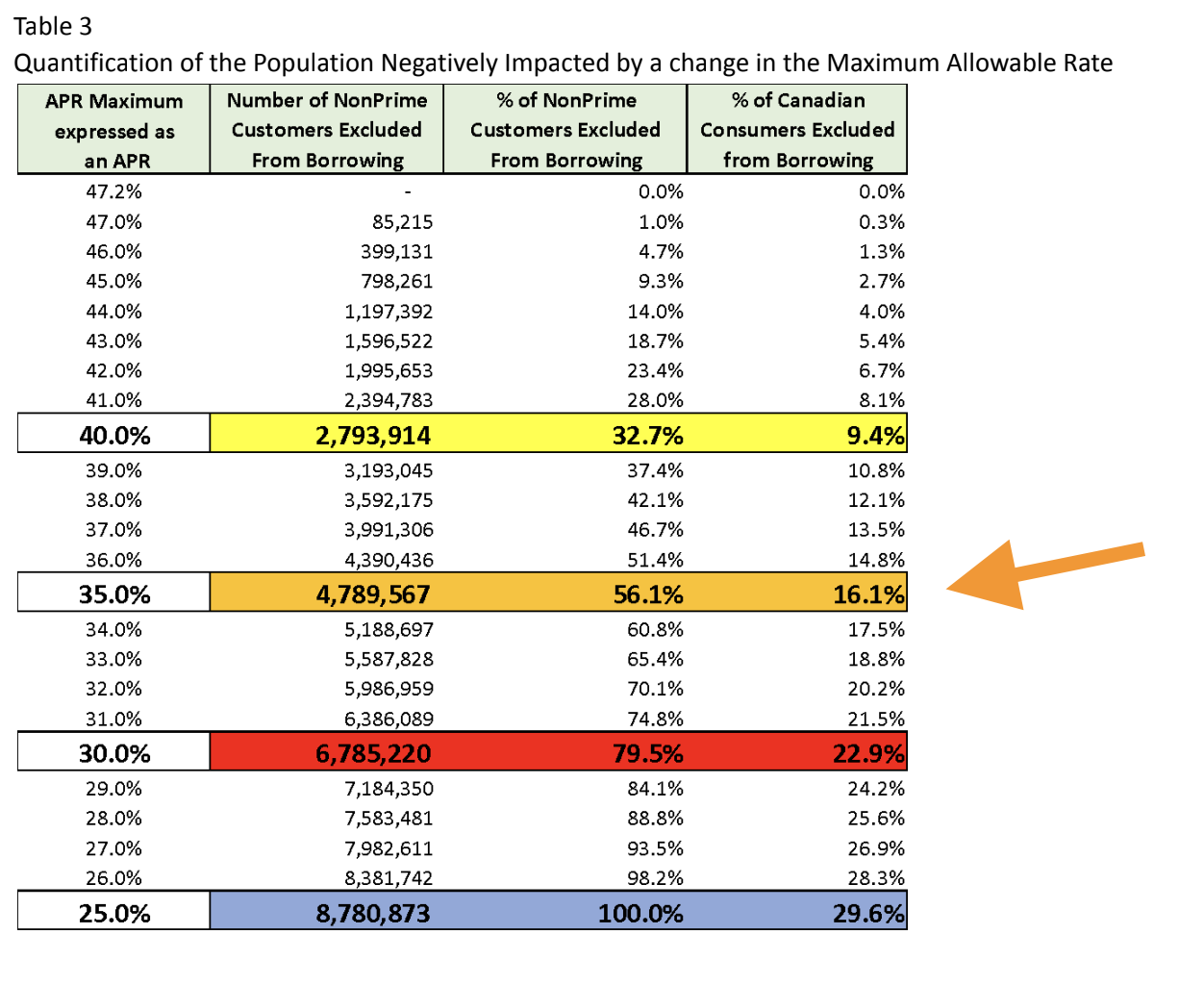

How we calculate that 4,789,567 Consumers May Be Left Without Access to Credit.

A subcommittee of the Risk Roundtable representing CROs from companies servicing the sector calculated that approximately 4.7 million Canadians would be negatively impacted should the rate be dropped to a 35% APR.

In calculating the reduction in the qualifying APR, the Risk Roundtable subcommittee notes that any reduction in the maximum allowable rate would negatively impact up to 80% of the entire Non-Prime/Unscorable segment, which accounts for almost a quarter of the Canadian population.

The Canadian Lenders Association’s Risk Roundtable, which represents risk officers from across the lending spectrum, has utilized a quantitative methodology to estimate the number of Canadians who would be negatively impacted by a reduction in the maximum allowable rate. CLA Members are permitted to reference these estimates as part of any representation to the Federal Government provided the appropriate notation is included with their submission.

Until this point, the Criminal Code’s effective annual interest rate of 60% was the maximum allowable rate in Canada. This was equivalent to a nominal annual percentage rate (“APR”) of ~47%, a measure that is more familiar to consumers when referring to the borrowing cost for nearly all credit products requiring regular repayments.

As of December 31, 2021, there were a total of 26,665,749 Canadians with credit reports according to TransUnion of Canada. Utilizing TransUnion’s Credit Vision score, 8,237,031 Canadians or 27.8% of the population are considered Non-Prime while 21,127,327 or 71.2% are considered Prime. A total of 301,481 Canadians or 1.02% of the population are considered Unscorable. Collectively, Non-Prime consumers held $186.6 billion in consumer credit balances consisting of credit cards, lines of credit, auto loans and installment loans while Prime consumers held $661.5 billion and those without a credit score held $2.8 billion.

Here is the full document to review.

220628 – Calculating Qualifying APR – CLA Risk Roundtable.docx

The chart below, developed by risk specialists in the CLA’s Risk Roundtable, sheds light on the broader implications of a reduction to the maximum rate of interest. This chart details the number of NonPrime Canadians that will be negatively impacted by a reduction in the maximum APR.

Now, let’s examine why this could become the new normal for everyday Canadians.

Payday loans are a type of short-term loan that typically have high interest rates and fees. They are often used by people who need quick cash to cover unexpected expenses or to make ends meet between paychecks. The high interest rates and fees of payday loans can quickly add up, making it difficult for borrowers to pay back the loan on time. This can lead to a cycle of debt where borrowers take out more loans to cover the previous ones, trapping them in a never-ending cycle of debt.

Payday lenders operate under a legal loophole that allows them to charge exorbitant interest rates to borrowers. Section 347.1 of the Criminal Code of Canada sets out maximum allowable rates of interest for loans, but payday lenders are exempt from these provisions if the loan amount is under $1,500 and repaid within 62 days. This exemption enables payday lenders to charge interest rates as high as 600% or more, leaving vulnerable borrowers in a cycle of debt that can be difficult to escape.

So, how does lowering the maximum rate of interest to 35% APR make things worse? Well, when the maximum rate of interest was 47% APR, well-vetted consumer lenders that are subject to the Criminal Code had more flexibility to offer loans to people with lower credit scores or higher risk profiles. With the rate now capped at 35% APR, lenders will have to be more selective about who they lend to. This means that people who were previously able to get an installment loan may no longer be eligible.

To view a comprehensive comparison between alternative and payday lenders, please click here.

The truth is that a considerable number of individuals facing financial difficulties have limited options available when it comes to accessing credit. They may have poor credit or limited income, making it difficult to get a traditional loan from a bank or credit union. Without access to a competitive landscape of well-regulated lenders, they may be forced to turn to other, more dangerous options like payday lenders, loan sharks, or unregulated online lenders.

So, while the government may have had good intentions in lowering the maximum rate of interest in the Criminal Code, the reality is that this change will hurt millions of people who are already struggling to make ends meet. It’s time for lawmakers to take a closer look at the unintended consequences of their regulations and start finding real solutions that will help consumers, not hurt them.

To read the CLA’s Response on the Consultation on Lowering the Criminal Rate of Interest in full, please click here.