What Canadian Lenders Expect from Payment Processors: A Data-Backed Look

Abstract: Canadian lenders are sharpening their focus on operational efficiency and compliance, and payment processors are no longer just back-end utilities. Based on a national survey of lenders—from fintech startups to established credit providers—the findings reveal strong demand for tools that reduce manual work, increase transparency, and simplify workflows. Rather than chasing flashy innovation, lenders are prioritizing recurring payments, reporting capabilities, and multi-client access that directly improve day-to-day operations. Processors who embed themselves as true partners in lender workflows will capture the greatest share of this competitive market.

As Canadian lenders scale and adapt to evolving regulatory, operational, and borrower expectations, their reliance on robust, flexible payment processors has never been greater. Based on a national survey conducted among Canadian lending companies—ranging from digital-first fintechs to established credit providers—this whitepaper outlines the specific features and capabilities lenders expect from their payment partners.

Top Findings from the Survey

- 80% of lenders prioritize Recurring Payments and Bulk Uploads to manage transaction volume and reduce manual workflows.

- 60%+ identified reporting, CSV uploads, and Virtual Terminal usability as essential for visibility and control.

- 57% cited the need for multi-client access and impersonation, especially among B2B platforms and aggregators.

- 38% ranked Real-Time Payments among their top five feature requests.

- <25% are prioritizing APIs or plug-in integrations—signalling a current focus on efficiency over innovation.

Payment processors who embed themselves into lender operations—offering simplicity, visibility, and flexibility—are the ones most likely to win and retain market share in this sector.

What Canadian Lenders Want from Payment Processors

Canadian lenders are at an inflection point. With pressure mounting from both compliance bodies and digital-native borrower expectations, lenders are tightening the seams of their operations. Payments—once treated as a back-end utility—have become a focal point for optimization. We surveyed leaders across Operations, Finance, Technology, and Compliance, and the results are clear: processors that reduce friction, provide transparency, and mirror lending workflows are preferred.

Recurring Payments & Bulk Uploads: Still Mission-Critical

80% of respondents ranked Recurring Payments and Bulk Uploads among their top features. Auto-scheduling repayments and uploading hundreds or thousands of transactions at once keeps overhead low and reliability high.

“We need to upload 1,000+ repayments weekly. If we cannot do that in one go, it is a showstopper.”

Operational Visibility: Reporting & File Compatibility Drive Confidence

- 65% want easy-to-generate transaction reports.

- 55% emphasized CSV/Excel compatibility.

- 58% cited Virtual Terminal usability as essential.

This demand supports reconciliations, audits, and accountability—core needs in regulated lending.

Multi-Level Admin Controls: Governance at Scale

- 41% highlighted the need for granular access controls.

- Teams want distinct view-only, edit, and approval roles.

- The requirement grows with firms of 10+ employees.

“Our compliance team needs audit trails. If every user has the same access, it is a liability.”

Multi-Client Access & Impersonation: Fixing a Common Pain Point

57%—especially aggregators and B2B platforms—are frustrated by the inability to manage multiple clients from a single login. Limited impersonation slows support and inflates handling time.

“Having to log in and out of each sub-client account is a huge time waster. We need true multi-tenancy.”

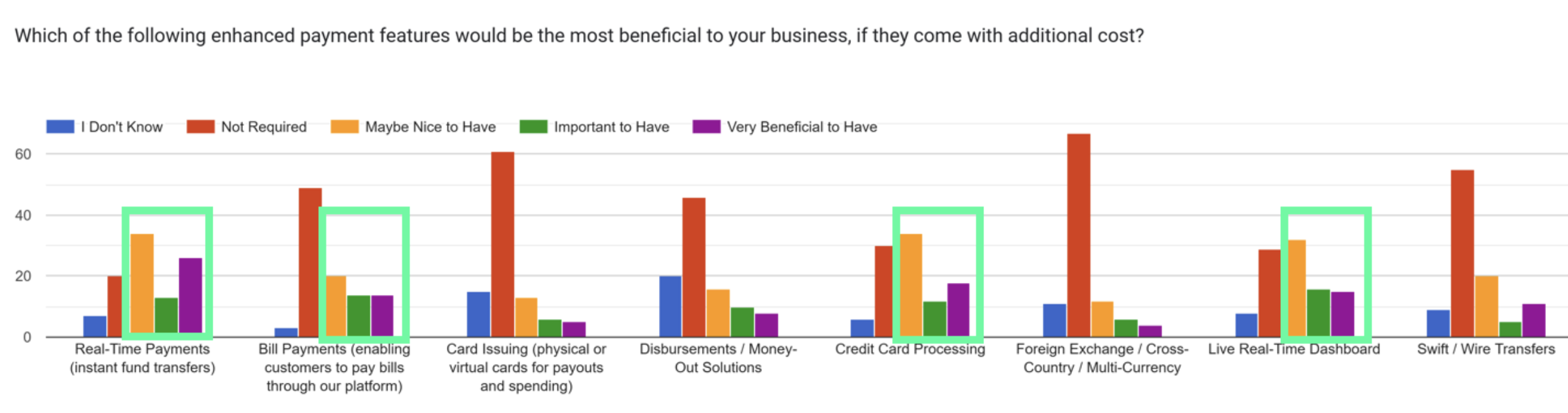

Real-Time Payments: Gaining Ground with Interac

Interest in near real-time capabilities such as Interac Send and Receive is rising, even if not yet industry-standard.

- 38% listed real-time payments in their top five features.

- Use cases: emergency disbursements, early wage access, automated collections.

- Adoption remains early, but forward-looking lenders are pushing for it.

See our related announcement: Accept/Pay Global Launches Real-Time Payments with Interac.

Efficiency > Innovation: Back to Basics

- Only 22% ranked API integration in their top five.

- <10% prioritised new plug-ins or crypto features.

- Focus is on onboarding speed, training ease, and reporting clarity.

“We do not need a ‘super app.’ We need clean data, low error rates, and fast support.”

Processors Must Think Like Operators

The message is clear—Canadian lenders want more than technical capabilities. They want payment processors who function as operational partners by:

- Prioritizing bulk tools that eliminate manual labour

- Enabling flexible access models for compliance and efficiency

- Reducing friction with impersonation and multi-client dashboards

- Delivering reporting in lender-friendly formats

- Preparing for a future where real-time is the norm

Key Takeaways

- Recurring payments and bulk uploads remain non-negotiable (80% rank essential).

- Reporting, file compatibility, and virtual terminal usability are critical for oversight and audits.

- Governance tools like multi-level admin access grow in importance as organisations scale.

- Multi-client dashboards and impersonation are major pain points for B2B lenders.

- Real-time payments are gaining traction; flashy innovations remain lower priority.

Explore more insights on payments and compliance in Canada: Canadian lender payment trends and Bill 72 & NSF fee harmonization.