The Opacity Problem: Why Black Box Loan Decisioning Is Failing Lenders

Abstract: At the Canadian Finance Summit, a clear message emerged: black box loan decisioning is failing lenders—and borrowers. While AI-driven models promise efficiency, their lack of transparency creates serious compliance, ethical, and economic risks. These opaque systems often reject creditworthy individuals—especially from underserved communities—without explanation, undermining fairness and violating regulations like the ECOA. At RangeTeller, we offer an alternative: “glass box” decisioning that blends AI with human expertise, is fully auditable, and aligns with regulatory expectations. Our transparent models not only identify more creditworthy clients but also drive 60% higher profitability. As lenders face mounting pressure to be both inclusive and compliant, the path forward is clear: embrace explainable, responsible, and data-driven credit strategies that are smarter, fairer, and more sustainable.

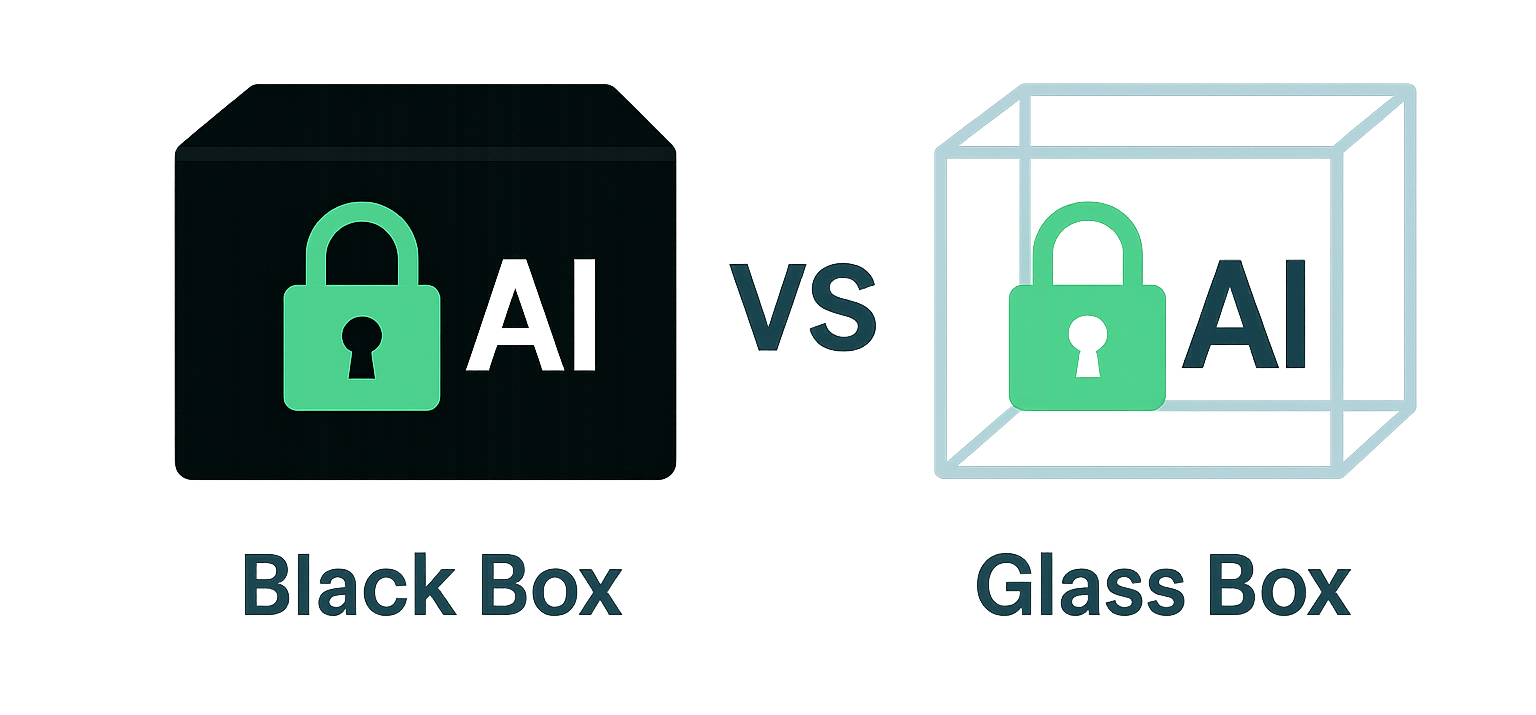

At the recent Canadian Finance Summit, I spoke with dozens of lenders about their decisioning frameworks and shared some of the lessons we’ve learned developing transparent—or “glass box”—solutions. It felt a bit like running a “Pepsi Challenge” at the booth—and let’s just say Coke wasn’t winning. Lenders consistently gravitated toward what we believe is the future: a decisioning framework that blends human insight with AI, is fully transparent, and meets regulatory expectations out of the box.

In the age of artificial intelligence, automated loan decisioning is quickly becoming standard across the Canadian lending landscape. But as banks and fintechs increasingly rely on opaque “black box” models to make high-stakes credit decisions, a pressing concern emerges: when algorithms replace underwriters, who ensures fairness, transparency, and accountability?

Black box models—especially those powered by deep learning or ensemble techniques—may offer speed and efficiency, but they also come with a cost: opacity. These systems often identify statistical correlations but provide little or no explanation for why a loan was approved or denied. The result? A credit ecosystem that’s fast, but fundamentally unaccountable.

This lack of transparency has serious implications. In the U.S. alone, over 7 million personal loan applications are rejected every year solely because the applicant’s credit score isn’t high enough. These rejections, often based on outdated or overly rigid scoring systems, overlook individuals who are creditworthy. And disproportionately, these applicants come from underbanked or marginalized communities—further entrenching financial exclusion.

The cost of this status quo isn’t just ethical—it’s economic. Over the last decade, traditional banks have forfeited $50 billion in personal loan market share to fintechs that use more advanced and inclusive credit assessment models. But many of these fintech models introduce a new problem: explainability.

Even if a model drives higher approval rates, if it can’t clearly explain why someone was denied, lenders face compliance risks. In markets like the U.S., regulations such as the Equal Credit Opportunity Act (ECOA) require lenders to provide specific, understandable reasons for credit denials. A model that can’t do this isn’t just unfair—it’s noncompliant.

Unlike traditional credit models—which are one-dimensional and often fail to reflect local economic realities—We at RangeTeller leverage multi-dimensional strategies rooted in local historical data. And more importantly, it’s not just AI—it’s a collaborative decisioning framework.

Risk teams can proactively integrate their expertise, fine-tune decisioning strategies in real time, and understand—clearly—why every decision was made. Every model is defensible. Every output is auditable. Every strategy is transparent.

As regulatory pressure grows and public skepticism of AI intensifies, lenders are being called to make a choice: stick with opaque models that sideline fairness, or adopt systems that prioritize transparency, accountability, and equity.

At RangeTeller, we believe the future of lending isn’t just faster—it’s smarter, more human, and more accurate. Our early adopters successfully formulated strategies that identify 5-10% extra creditworthy clients, whilst being 60% more profitable. By empowering banks to proactively design responsible, scalable lending strategies, we’re helping the industry move beyond black box thinking—and toward a more intelligent, inclusive credit system.

Sign up for the CLA Finance Summit Series