|

54% of undergrads have student debt at graduation, owing an average amount of $28,000. In the U.S. this number has reached over $1.7 trillion.

Startups in this space are developing technology to target both private and federal loan debt in areas, such as responsible lending, loan management and refinancing, as well as make it easier for employers to create benefits that aid employees with their loan repayments.

Who are we talking about?

-

SoFi, the recently SPAC’d student lender, made its name in student refis before putting its name on the home stadium of the LA Rams.

-

Rightfoot, an API that allows companies to embed student loan repayment into their products. For example, a payroll provider can hive off a portion of your paycheck to help you pay off your student debt automatically.

-

Quadfi is a Canadian fintech that offers personal loans to students who are often overlooked by traditional lenders for a lack of credit history.

-

Snowball Wealth helps students intelligently paydown their debt through targeted savings plans and debt consolidation.

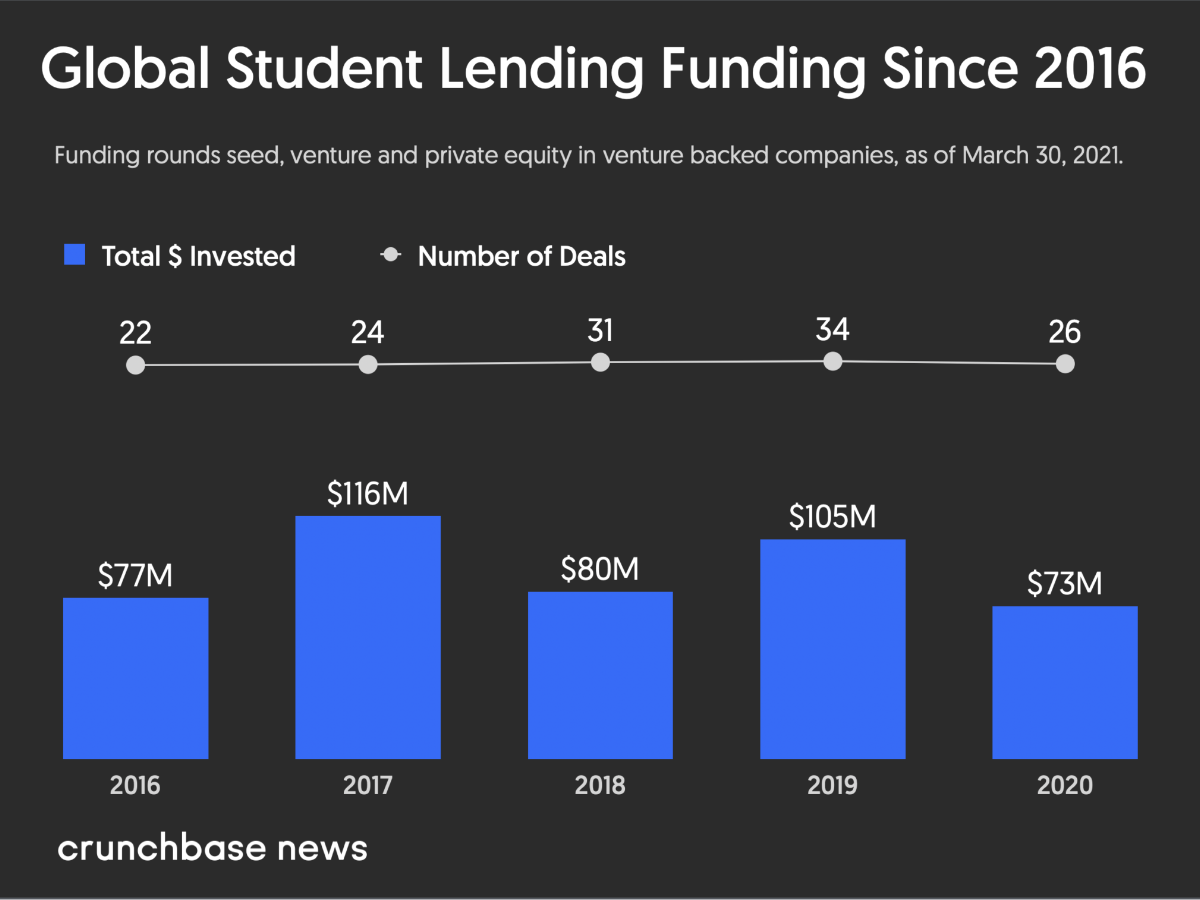

Since 2016, investors have pumped at least $517 million into companies in this space

|