Retrofits: Energy as a Service (EAAS) is the Missing Link

Abstract: Canada’s building sector is falling behind on its net-zero targets because traditional financing and piecemeal retrofits cannot deliver the scale of change required. Energy as a Service (EaaS) offers a transformative model—where building owners pay for outcomes like heat or light instead of owning equipment—bringing in the right capital, expertise, and risk-sharing to accelerate deep retrofits across the country.

Canada’s buildings are responsible for more than 80 megatons of greenhouse gas emissions each year. Since 2005, we’ve barely made a dent—shaving just one megaton from that total despite billions of dollars in pilot programs, rebates, and incremental improvements. At this pace, we will fall well short of our net-zero targets.

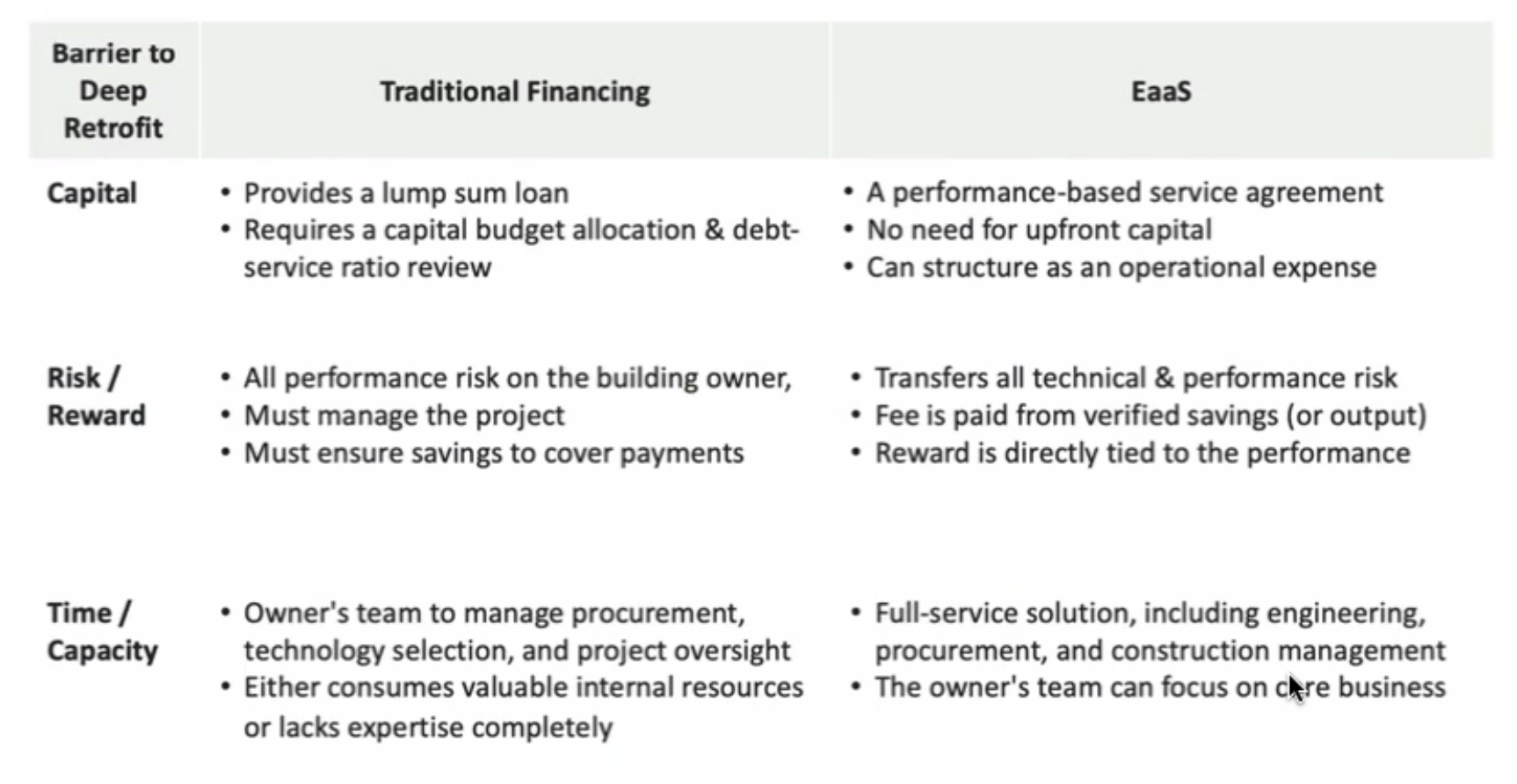

The problem isn’t that we lack solutions. We know how to decarbonize buildings through deep retrofits—replacing boilers with heat pumps, layering in solar, adding smart controls, and more. The problem is structural: our financing and delivery models weren’t designed for the scale and complexity of today’s challenge.

That’s where Energy as a Service (EaaS) comes in. Just as Xerox transformed office equipment by shifting from ownership to “pay-per-copy,” EaaS allows building owners to buy outcomes—lumens, heat, cooling—without owning or managing the underlying infrastructure. Instead of tying up scarce capital and assuming technical risk, owners can outsource performance to specialized providers who bring their own capital, expertise, and accountability.

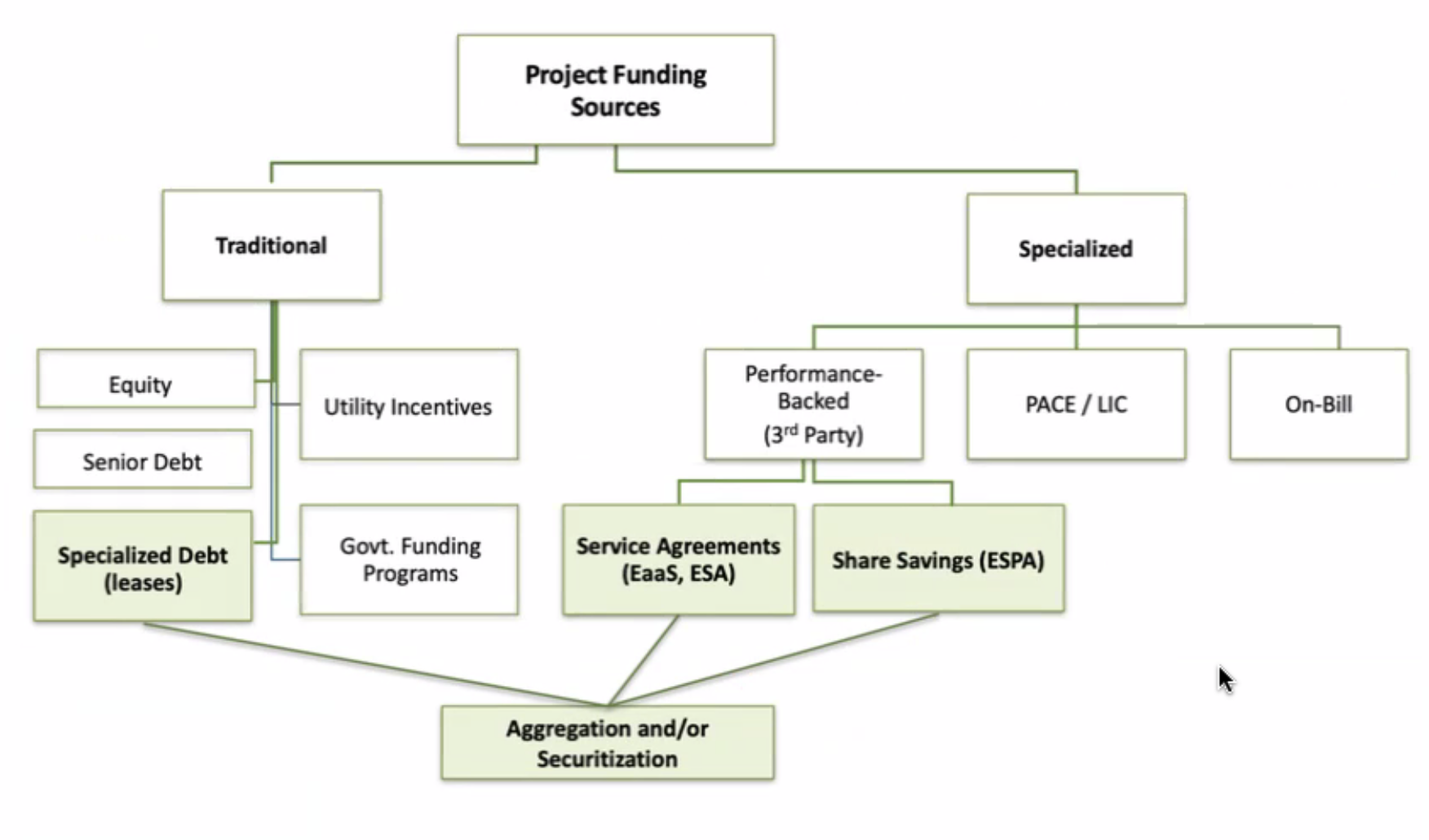

The financing gap is staggering. We currently spend about $6 billion annually upgrading energy infrastructure in buildings. To reach net zero, we need $30–70 billion every year. Traditional mortgages, utility rebates, and government programs are simply not enough. And even when capital is available, it often comes with terms misaligned to retrofit realities: five-year loans for 20-year paybacks, or balance-sheet debt that maxes out borrowing capacity.

Beyond capital, building owners face two additional barriers:

- Complexity: Deep retrofits involve interconnected systems—heat pumps, solar panels, time-of-use pricing, demand-response programs. This requires in-house engineering capacity most landlords lack.

- Capacity: Owners plan upgrades piecemeal—LEDs one year, boilers the next—rarely scaling multi-measure retrofits across portfolios at once.

Energy as a Service solves all three barriers at once: the right capital, the right expertise, and the right delivery capacity.

At Efficiency Capital, we partner with landlords, property managers, and lenders to structure performance-based service agreements. There’s no upfront capital. We design, build, finance, and operate retrofit systems. Owners pay for verified performance—heat, cooling, savings—rather than equipment. Risks transfer from landlord to provider. And because our returns depend on performance, we’re aligned with owners in optimizing systems over time.

This approach doesn’t replace debt; it complements it. In fact, lenders are increasingly engaging with us as they seek to decarbonize their books. By replacing the equity slice of the capital stack, we accelerate projects that otherwise wouldn’t pencil out.

Of course, this is a new business model, and customer education is key. Owners often pause at the idea of an external party owning their boilers or lighting systems. But when faced with government mandates—like leased federal buildings in Ottawa and Victoria required to be net-zero ready—or the looming replacement of aging systems, the value becomes clear. Our typical engagement moves from first meeting to signed term sheet in two to four months, with installations complete within the year.

If Canada is serious about meeting its climate commitments, we must move beyond incrementalism. Traditional financing and rebate programs won’t close the gap. Energy as a Service provides the missing link—unlocking the capital, expertise, and capacity to transform our building stock at scale.

The good news is that the model already works. It’s time we bring it to the mainstream.

Five Key Insights

-

The Investment Gap: Canada invests about $6B annually in building energy infrastructure but needs $30–70B per year to reach net zero.

-

Beyond Capital: Barriers aren’t just financial—building owners also lack the technical expertise and internal capacity to manage complex retrofits.

-

Aligned Incentives: Under EaaS, providers finance, install, and operate systems while owners pay for verified performance, aligning risk and reward.

-

Equity Replacement: EaaS complements, rather than replaces, traditional debt by taking the equity slice of the capital stack, enabling lenders to decarbonize their portfolios.

-

Trigger Points Drive Adoption: Owners often adopt EaaS when faced with aging equipment, government mandates, or tenant pressure for greener buildings.

/article>

Sign up for the CLA Finance Summit Series