Reinventing Home Services Finance:

Why Digital Trust Is the Next Frontier

Abstract: For decades, Canadian homeowners have been forced to navigate a fragmented, paper-heavy process when it came to financing home improvements. Carbon paper contracts, disjointed channels, and long delays were the norm. Today, however, the tide is turning. The home services and lending sector is undergoing a digital transformation—and the results are profound. The future is not just digitization, but digital trust. By marrying technology with transparency, we can lower costs, reduce fraud, and dramatically improve customer experience.

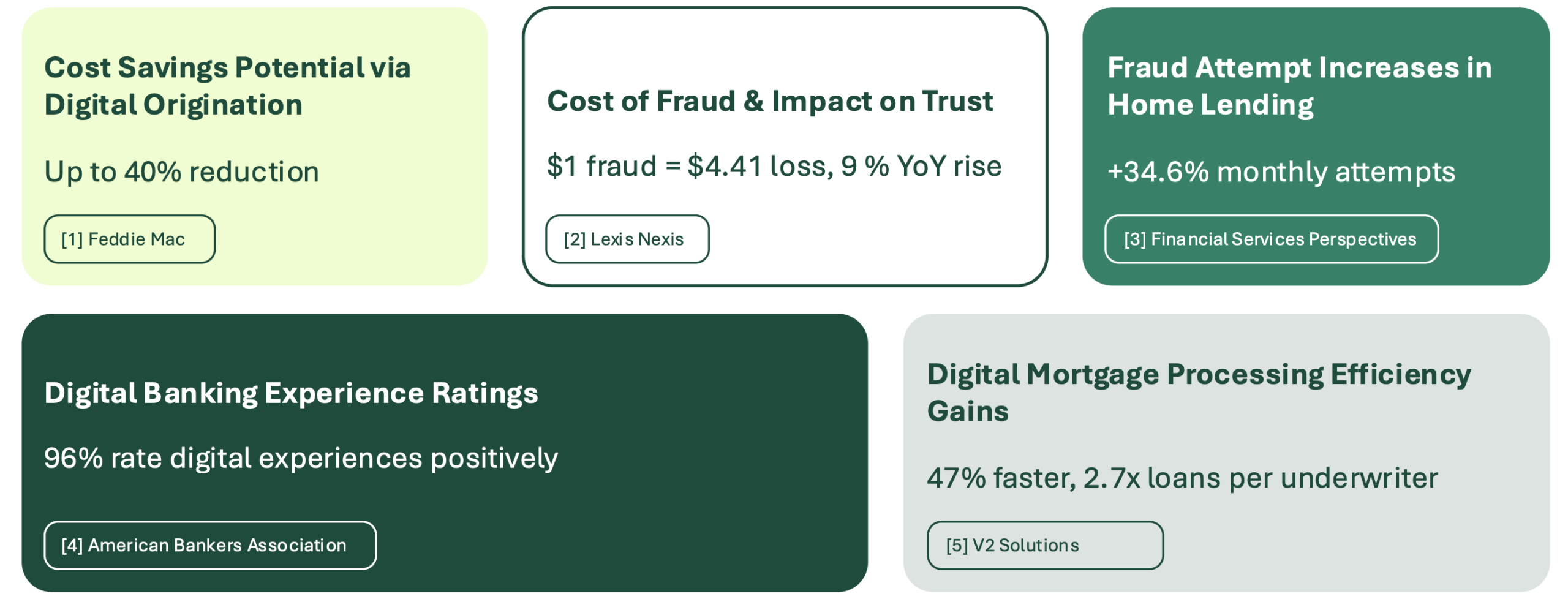

Legacy systems in home services financing were built for another era. A consumer signs on carbon paper, a clerk retypes data into a system, and a lender manually reviews it. Every handoff introduces errors, delays, and risks. Fraud is a constant threat: in fact, every dollar lost to fraud costs companies more than $4 in total, according to LexisNexis. Meanwhile, home lending fraud has risen by over 30%.

For customers, this meant confusion, distrust, and inefficiency. For providers, it meant defaults, unnecessary costs, and an inability to keep pace with digital-first consumer expectations.

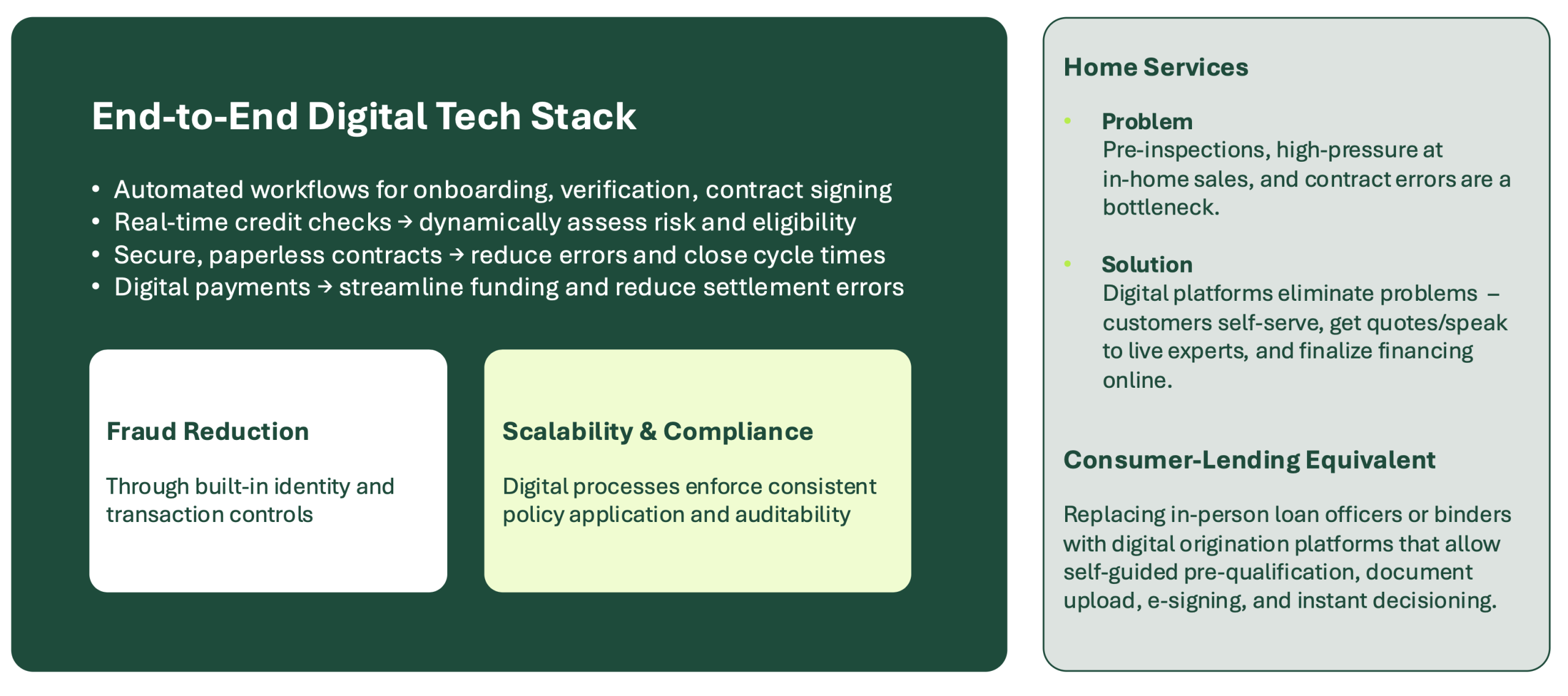

We made a decision most incumbents cannot: we scrapped the old systems and built fresh. That allowed us to design a fully integrated platform where data flows seamlessly between touchpoints—whether a customer walks into a retail store, texts us from home, or applies entirely online.

We didn’t just digitize forms; we rethought the customer journey end-to-end:

- Pre-qualification and credit adjudication built into the platform.

- 100% digital contracts, modeled after consumer tech leaders like Apple.

- Transparent online pricing for every product, eliminating guesswork.

- Paperless payments with pre-authorized debit and credit.

- Same-day and next-day installation, where the decision is made online and the product is in the customer’s home within hours.

The payoff has been striking: defaults down, operating costs down, and customer satisfaction up. A quarter of our transactions today are entirely digital—completed without a single human interaction prior to installation.

- https://sf.freddiemac.com/docs/pdf/cost-to-originate-full-study-2024.pdf

- https://risk.lexisnexis.com/about-us/press-room/press-release/20240424-tcof-financial-services-lending

- https://www.financialservicesperspectives.com/2024/05/the-escalating-threat-of-mortgage-fraud

- https://www.aba.com/news-research/analysis-guides/preferred-banking-methods

- https://www.v2solutions.com/blogs/digital-mortgage-revolution-loan-processing

The surprising discovery has been how much trust customers will place in a digital process once they see it work. A homeowner who once doubted the idea of buying a water heater online now refers neighbours after a flawless experience. Reviews and referrals have become our greatest growth driver.

Of course, digital is not one-size-fits-all. Seventy-five percent of our customers still prefer mediation—an email, a WhatsApp chat, or a phone call. That’s why our approach is “digital-first, not digital-only.” Technology empowers the process, but people remain central.

Our journey offers a few lessons for financial services and home improvement leaders:

- Start with a clean slate where possible. Retrofitting legacy systems often creates more friction than it solves.

- Invest in transparency. Posting pricing online was a bold move, but it built trust quickly.

- Design for speed. In a world where a basement flood can’t wait, same-day solutions aren’t luxuries—they’re expectations.

- Use digital to cut fraud, not just costs. Paperless, secure, automated verification reduces vulnerabilities.

- Balance automation with human support. The best digital platforms don’t remove people; they empower them.

We are only at the beginning. The majority of Canadians now expect their financial transactions to be digital, and the efficiencies are undeniable: mortgages processed 47% faster, underwriting capacity doubled, customer satisfaction up.

Building Frictionless Lending & Transactions Playbook

But the real revolution lies in building trust—creating platforms where customers know their data is safe, their contracts are clear, and their problems are solved faster than ever. That is the path we have chosen at GOLIME, and it is reshaping not only our company but the entire home services finance sector.

Five Key Insights from Our Digital Transformation

1. Retrofitting Doesn’t Work — Start Fresh

Legacy systems are riddled with inefficiencies. We scrapped paper processes and designed a new, API-driven platform from the ground up, enabling real-time contracts, payments, and installations.

2. Transparency Builds Trust

By putting 100% of our pricing online and digitizing contracts, we eliminated the guesswork. Customers know exactly what they are paying for, and trust follows transparency.

3. Speed Is a Competitive Advantage

A basement flood or broken furnace can’t wait. Our same-day and next-day service—made possible by seamless digital workflows—has become a critical differentiator.

4. Digital Reduces Fraud and Cost

Paperless verification, automated adjudication, and integrated payments have significantly lowered fraud exposure and default rates, while reducing operating expenses.

5. Digital-First, Not Digital-Only

Twenty-five percent of our customers complete transactions without human contact, but the majority still want touchpoints. Balancing automation with expert support has been key to scaling trust and adoption.

Sign up for the CLA Finance Summit Series