|

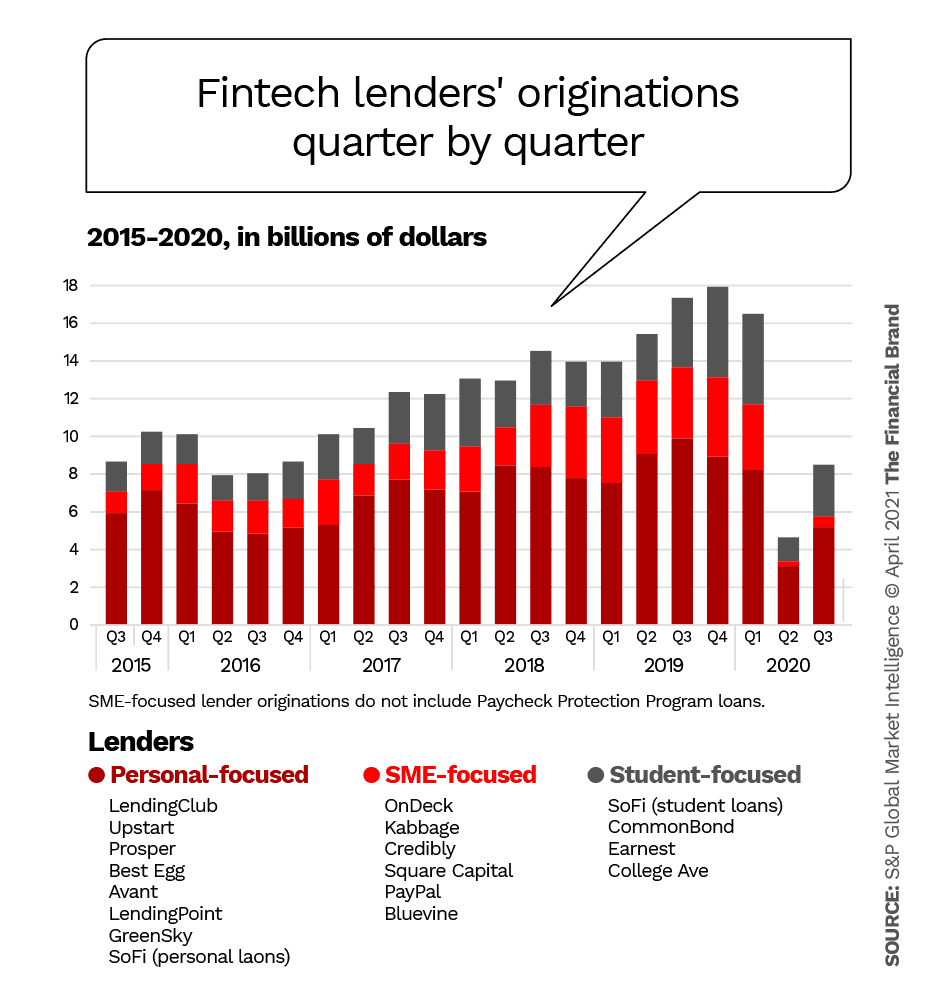

A recent report by S&P Global Market Intelligence paints an optimistic picture for fintech lenders in a post-pandemic environment.

-

Unsecured personal lenders are projected to rise in volume by 51%, to $47.9 billion in originations annually.

-

Small-and medium-sized business lenders are expected to rise by 16.1% to $15.8 billion.

-

Student lenders are forecast to rise 152% to $32.8 billion.

|